Product Idea

10 Months Spread Note HDFC Bank (Long) / Tata Motors (Short)

The Headquarters of HDFC Bank in Mumbai and the interior of the supermini hatchback Tata Bolt produced by Tata Motors since 2015. IMAGES HDFC BANK / TATA MOTORS

Over the years, India has established itself as one of the leading emerging market economies. It may come as no shock that many investors tend to have a positive view on many of its larger companies. Due to restrictions on direct foreign investment, many participants access the market using structured products and the liquid ADR’s, namely; HDFC Bank, ICICI Bank, Infosys Ltd and Tata Motors Ltd. There are 2 stocks in particular that are the main focus of this article.

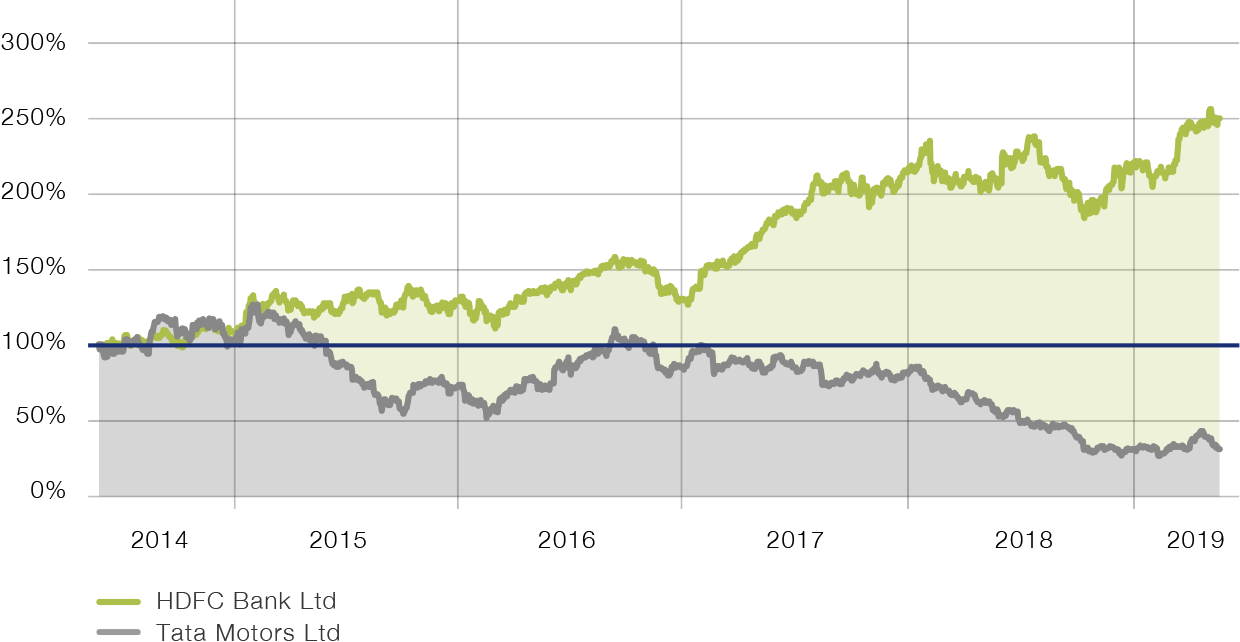

A spread note provides an investor the opportunity to capitalize on the relative outperformance of one stock over the other. This investment idea focuses on being long the best performing ADR and short the worst performing ADR. Over the past 5 years, HDFC Bank Ltd has had an annualized return of +21.70% whilst Tata Motors Ltd has had an annualized return of -19.66%. Thus, if this trend is assumed to continue for the foreseeable future it would be ideal to be take a Long/Bullish view on HDFC Bank Ltd and a Short/Bearish view on Tata Motors Ltd.

Key figures

| HDFC Bank Ltd (HDB UN) | Tata Motors Ltd (TTM UN) | |

| P/E Ratio | 30.20 | 10.40 |

| P/B Ratio | 4.75 | 0.78 |

| Dividend Yield (%) | 0.50 | – |

| 3Y Revenue CAGR (%) | 20.43 | -3.73* |

| 3Y Net Income CAGR (%) | 20.37 | -0.19* |

| 3Y EPS CAGR (%) | 17.97 | -0.20* |

| Average Analyst Rating** | 4.38 | 3.65 |

| 12M Return Potential (%)*** | 3.60 | 29.00 |

| Buy / Hold / Sell* | 30 / 4 / 3 | 18 / 18 / 4 |

* As of 2018 FY end

** Indian Exchange Traded stock used as ADR not well covered by analysts

*** Calculated as Average 12M Analyst Target Price divided by the Spot Price

(Source: Bloomberg)

5 Years Performance of HDFC Bank & Tata Motors

Your Contact

Christopher Kumpas

CIO Picard Angst MEA

+

This content has been created by Picard Angst MEA Limited, and is merely a summary of the essential characteristics of the product and not a complete representation and has been created solely for information purposes for use by the recipient for the duration of the subscription period. The information provided is valid for this period. The information on this site does not constitute financial analysis and does not meet all legal requirements to ensure the impartiality of financial analysis and is not subject to a prohibition of trading prior to the publication of financial analysis. This site does not contain any offer or invitation to buy or sell financial instruments. It is intended for informational purposes only. Since a structured investment product can be a complex financial product, the decision to invest should therefore always be made on the basis of a consultation with a bank advisor. The information on this page on opportunities and risks does not replace the information provided by your investment advisor, which is indispensable in every case before a transaction is concluded. Only those who are unambiguously aware of the opportunities and risks of the transaction to be concluded and are economically in a position to bear any losses that may arise should enter into such transactions.