India Q1

Time to do some shopping

India’s economy is flying on a strong engine: consumer spending. Busy Brigade Road shopping street in Bangalore, capital of the state Karnataka. PHOTO GAVIN HELLIER KEYSTONE / ROBERT HARDING

During my recent trip to India, I had intensive discussions with the management of a dozen of SMEs, several analysts and fund managers. All discussions came to the same conclusion: it’s is time to go shopping in India. We did that and discovered some interesting things.

The most interesting outcome from these interactions was that majority of the Indian companies are building the capabilities and scales to address the new breed of Indian consumers and the digital demand. They are adjusting their products and services to meet the requirements of the 700 mn Indian Millennials (75% of them use smart phones).

The discussions with key infrastructure companies confirmed that there is a broad-based pick up in the infrastructure capex cycle. They have executed higher amount of order book with low amount of capital employed. The last nine months were quite robust for these companies. Moreover, the private sector capex reveals signs of recovery amid central and state government pre-election spending.

The companies in the consumer sector witnessed healthy revenue growth of 10-12% however their margins came under pressure due to high raw material prices and INR volatility. But moderation in raw material prices and the stability in INR witnessed since January 2019, will support the margins to recover in the next quarters.

What I learnt in a Bata Store in Mumbai

The evolution of the Indian consumer patterns is amazing. Discover Chrys Kamber’s insights after visiting a Bata store in Mumbai. Video Length 01:34 Min.

Ideal time to invest

My discussions with several domestic fund managers further strengthened my conviction that the next two months would be an ideal time to increase the small and mid-cap exposure. These two segments are trading at a valuation of -1 std to their long-term average. Their stock prices have come off dramatically but their longer-term value still remains intact.

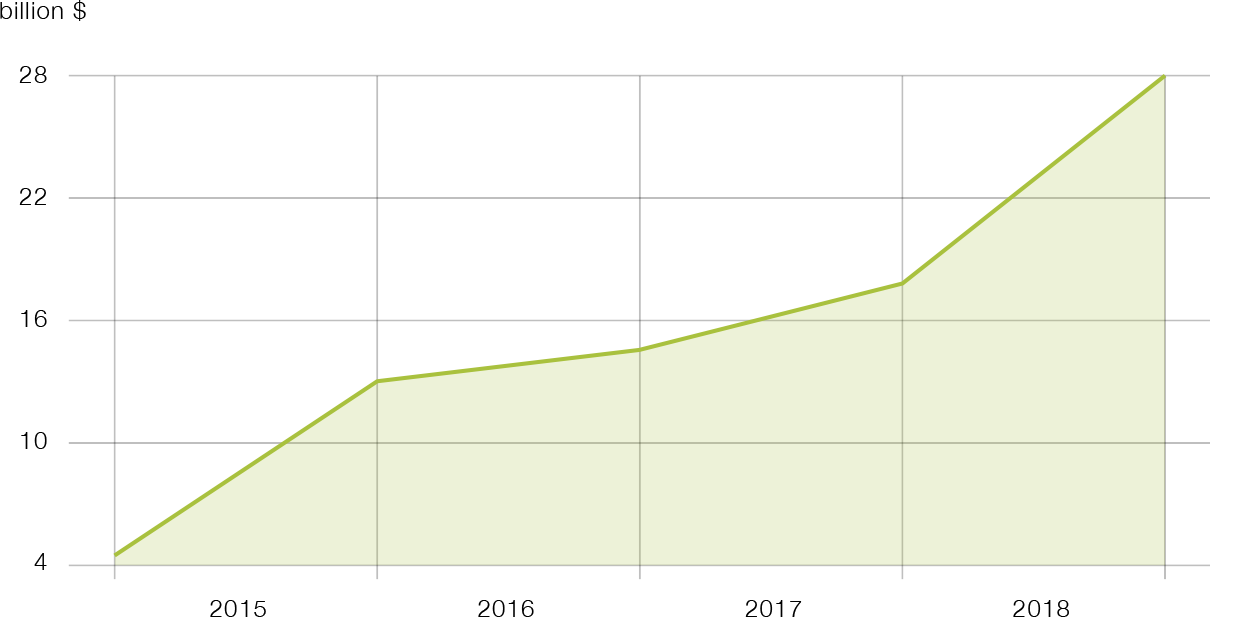

Indian E-Commerce is increasing exponentially

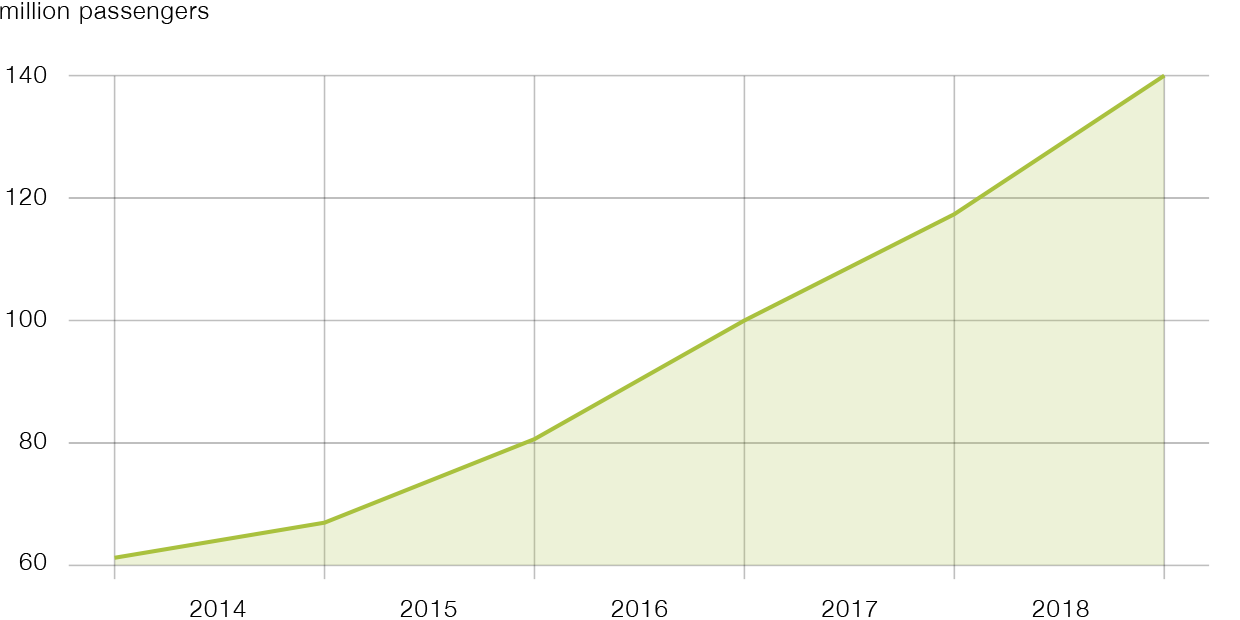

More and more Indians are travelling by air

Why to invest in small and mid-caps now

- Political uncertainty due to the elections will be soon over. Market is factoring a majority win for Mr. Modi after his strong stance against the terrorist attack, hence ensuring political continuity.

- RBI has abandoned its hawkish stance and has cut 25 bps in January. We expect further rate cuts as the inflation is at 19 months low. Moreover the US Fed has changed its tone from contentious rate hikes towards patient rate stance.

- Infrastructure capex has started and the private capex will follow.

- After a severe correction is the small and mid-cap segment, the valuations have reached attractive levels right now. They are back to 2013 levels and the differential between Nifty 50 Index and Small/Mid cap Indices are at the lowest since 2008. Historically they tend to rebound strongly after reaching these level.

- Easing monetary policy, low inflation and a strong GDP growth prospects bode well for the SME segment.

- Capacity utilization at 74.8% is above 10-year average, historically above average capacity utilization propels the investment acceleration.