1. Macroeconomic Trends

Headwind in the global economy

Dr. David-Michael Lincke, Head of Portfolio Management

In brief

- The disappointing economic outlook continues unabated across the world, with little sign of that this trend will reverse in the near future.

- It is true that the US Federal Reserve has turned the tide and switched to a course of monetary easing; however, the historical track record of efforts made by monetary policy to avoid recessions does not inspire much confidence.

- The escalation of the trade conflict between the United States and China is turning into an endurance test for world trade. If an amicable settlement is not reached in the near future, it will have a significant negative impact on the growth of the global economy.

- The vulnerability of the global financial system and the fragile state of the world economy is underscored by collapsing inflation expectations.

- Despite expectations of falling key interest rates, the US dollar has remained strong to date. However, this is likely to change in the second half of the year.

Outlook

There are few indications that the economic outlook will change soon. In particular, it is becoming apparent that the United States can no longer escape the downturn in the rest of the world. Taking historical track record as a yardstick, the central banks' shift to a course of easing could be too late. Collapsing inflation expectations underscore the recessionary trend, and the escalation of trade disputes promises additional headwinds for world trade and the global economy.

Comment

The disappointing development of the economic outlook continues unabated worldwide

As expected, the severe correction on the financial markets at the end of the previous year turned out to be an exaggeration. Widespread fears of recession were at least premature. However, the rapid recovery, especially on the stock markets, was not accompanied by a brightening of the economic outlook.

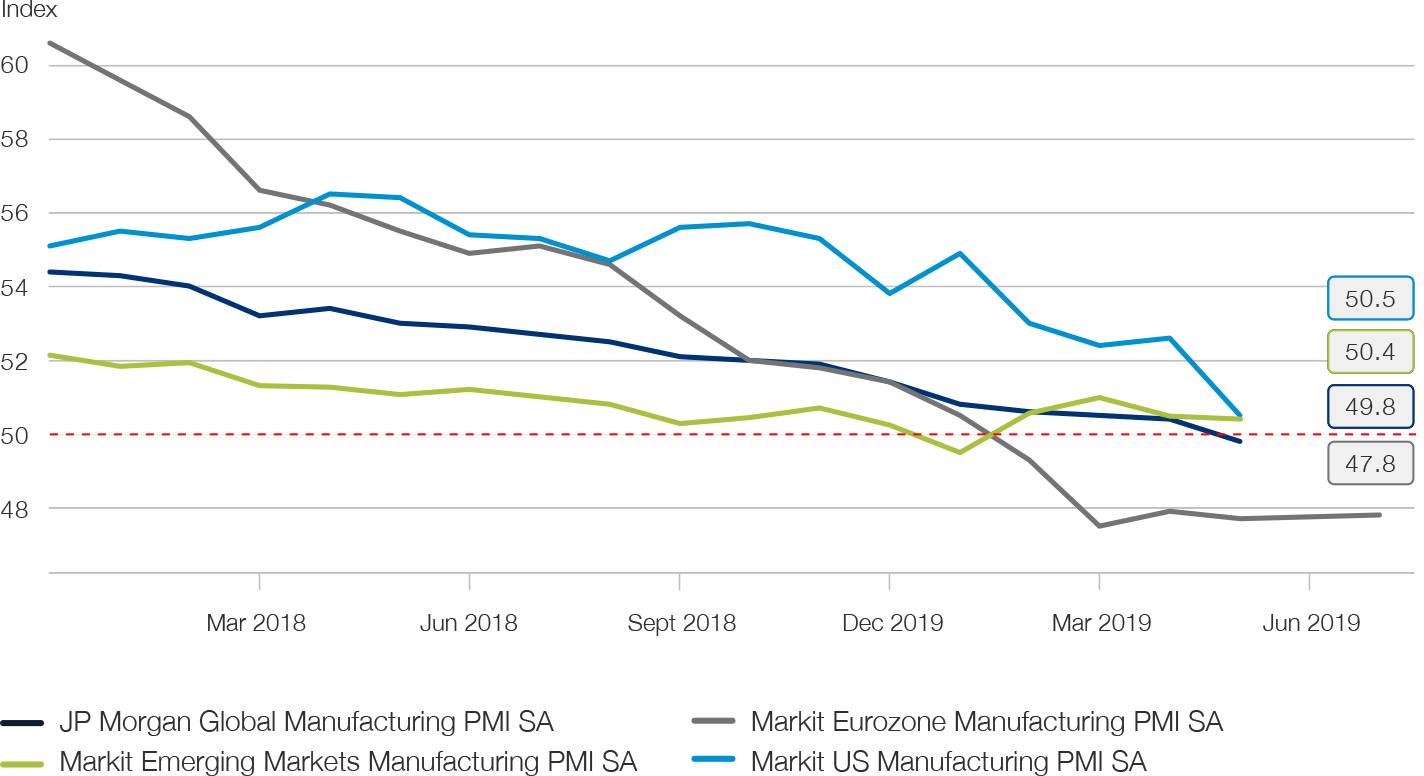

On the contrary, the weakening trend in leading economic indicators such as the Purchasing Managers' Indices for the manufacturing and service sectors, which had already been observed over the entire previous year, continued unabated in the first half of the year across the globe (see Fig. 1). The signs for the Eurozone in particular are now pointing to contraction. In China, too, the Purchasing Managers' Index has fallen below the expansion threshold of 50 and is weighing on the growth prospects of the emerging markets.

Fig. 1

The weakening trend in leading economic indicators has continued unabated throughout the world

Even the United States, which has long held its ground as the spearhead of growth in the OECD region, is showing increasing signs of fatigue. For example, Citi's Economic Surprise Indexes illustrate that economic figures have been lagging particularly far behind market expectations since the beginning of the year (see Fig. 2). In the rest of the world, however, economic optimism has already largely evaporated.

Nevertheless, estimates of global economic growth in the current year have so far remained surprisingly robust. Despite a downward revision of expectations in recent months, the International Monetary Fund still expects an expansion of 3.3%. By contrast, the World Bank has reduced its forecast more dramatically to 3.7%.

Fig. 2

US economic data in particular lag well behind expectations

There are few arguments for an imminent turnaround. In the United States, for example, the fiscal stimulus from last year's tax reform has been exhausted. Hopes of a broad-based investment boost from companies have not materialised. Although full employment on the labour market is fundamentally positive, it also means that there is no reason to expect a continued spurt in exceptional employment growth. Due to the combination of demographic factors and sustained declining productivity growth, future real growth rates of barely more than 1% p.a. can be expected for the United States.

It should also be borne in mind that, in the case of the United States, this is now the longest economic expansion in the post-war period. From a statistical point of view, a recession is therefore becoming more and more likely. Over the past few weeks, various regional and sector-specific economic indicators as well as the inversion of sections of the yield curve have been providing early warning signals in this respect.

Europe is now suffering from political paralysis and confrontation. The substantial gains made by populist and right-wing parties in the European elections will not be conducive to an urgently-needed agreement on fiscal stimulus measures to replace monetary policy measures whose effectiveness has been depleted. France is in the process of gambling away hard-earned fiscal leeway to appease the Gilets Jaunes protest movement and the budget conflict between Italy and Brussels continues to escalate. However, the greatest downward economic potential is still presented by Britain's unregulated withdrawal from the European Union by – a scenario that can be ruled out less and less in view of the never-ending political scramble over the withdrawal modalities.

The emerging economies are finding it increasingly difficult to fulfil their intended role as the growth engine of the global economy. The extensive fiscal and monetary stimulus measures introduced by China over the past year have had only a very limited impact. It is questionable whether they will be sufficient to stabilise the growth path of the Chinese economy above the 6% mark, especially as the escalation of the trade conflict with the United States is increasingly producing headwinds. In general, the threat to world trade represents the greatest growth risk for export-driven emerging markets.

Can the dramatic turnaround in monetary policy change course for the economy?

The trend reversal on the financial markets in the first half of the year was supported not least by a turnaround in monetary policy in the OECD region. At the beginning of the year, it could still be assumed that the flood of liquidity from the central banks' printing presses, which over the past decade has helped to raise the valuations of risky asset classes to ever higher, sometimes dizzying levels, would definitely pave the way for a recession. Since then, however, the picture has changed dramatically and there is no longer any talk of a normalisation of monetary policy.

In December, the US Federal Reserve not only announced that it intended to raise key interest rates at least twice or three times in 2019, it also announced that it would continue to gradually dismantle its inflated CB balance sheet. However, shocked by the deterioration in the economic outlook, these plans were shelved as early as January and a 'wait-and-see' position was adopted. This was followed by the declaration of an end to interest rate hikes and the decision to stop the further reduction of the balance sheet as early as September 2019.

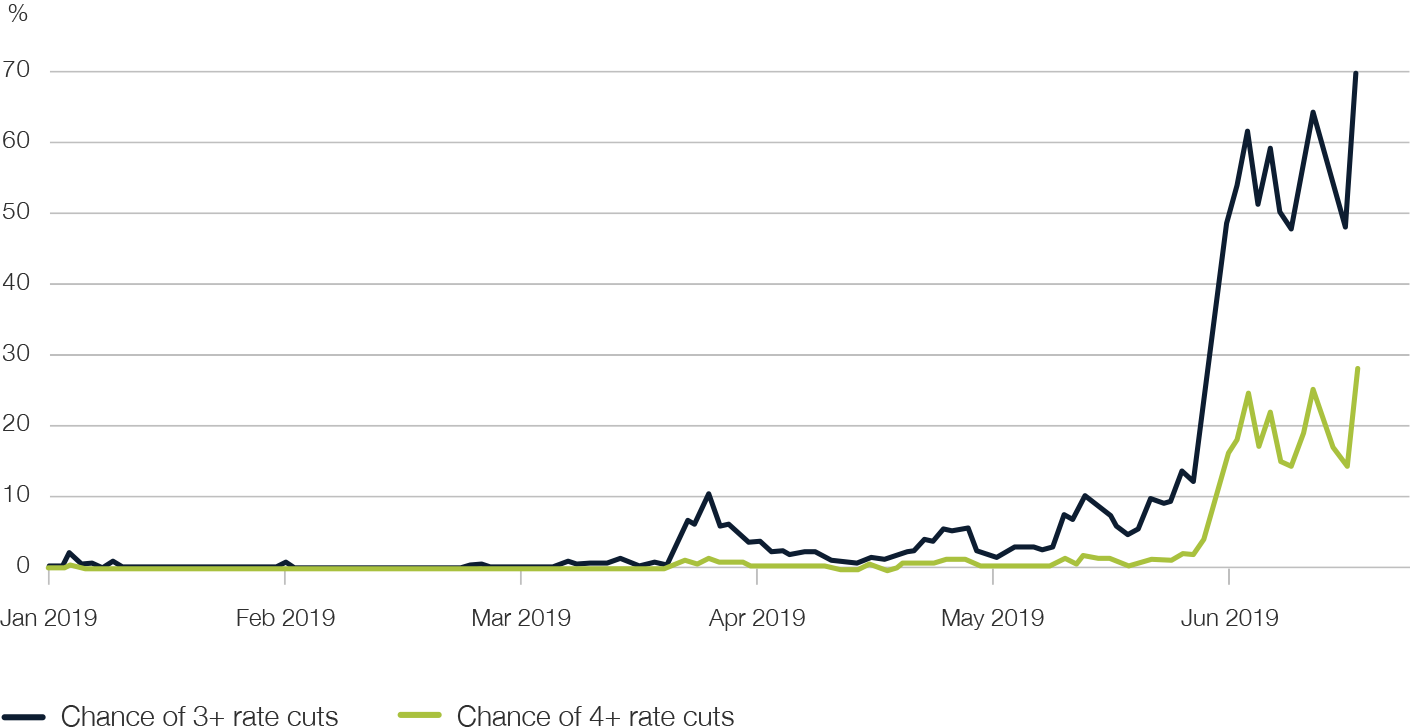

However, the market believes that the central bank is still falling short of the necessary measures. Hence the Fed Funds Futures market is highly likely to see more than three rate cuts for the remainder of the year, and even a fourth cut has not been ruled out (see Fig. 3).

Fig. 3

Development of expectations for key interest rate changes by the US Federal Reserve on the basis of the Fed Funds Futures Market

Against this backdrop, the question arises as to whether it is not already too late for the Fed to turn the tide and successfully avert a recession. The historical track record is not very encouraging. With the exception of 1967 and 1996, every interest rate cut that followed a cycle of rising interest rates inevitably led to a recession. In addition, with a cushion of only 250 basis points, there is considerably less ammunition available this time than in previous economic downturns, when the central bank felt compelled to lower key interest rates by an average of 375 basis points.

The European Central Bank's (ECB) options are even more limited in this regard, as it has postponed a normalisation of monetary policy until today. Nevertheless, the ECB not only recently ruled out raising interest rate before mid-2020, but even considered further interest rate cuts and flirted with resuming the QE programmes that were only discontinued at the end of 2018. The effectiveness of such steps are doubtful, however. On the one hand, this will put further pressure on the troubled European banking system, and on the other, the universe of eligible investments for the ECB's purchase programmes has largely run dry. In view of the lack of impact of European monetary policy, the credibility of ECB President Mario Draghi Kratzer has also been damaged, especially as his replacement is due this year.

The escalation of the trade conflict between the United States and China is turning into an endurance test for world trade.

The hope for a speedy and amicable settlement of tensions between the United States and China regarding bilateral trade relations was also a potent driver of the financial market recovery in the first half of the year. It is hardly surprising, then, that this ended abruptly in May when the talks collapsed.

It is certainly true that it was primarily the trade deficit with China which the Trump administration initially took exception to. It should not be forgotten, however, that the conflict has a much wider dimension and meaning. Ultimately, the United States is concerned with keeping an emerging competitor for global economic and military supremacy in check. This explains its increasing focus on the technology transfer forced by China, the danger posed by China's monitoring of foreign companies and President Xi's 'Made in China 2025' plan, which directly threatens the USA's technological dominance. The sanctions against the Huawei technology group should also be viewed in this context.

Although there is still a chance of de-escalation over the coming months, the increase in tariffs and their extension to other categories of goods and the retaliatory measures taken and considered by China will not only dampen the growth prospects of the two countries, but of the world economy as a whole. Even conservative estimates assume that this will reduce global economic growth by 0.5% by the end of 2020.

For the American economy alone, the consequences of continued escalation in the form of an extension of customs duties to all Chinese imports are much more dramatic. It is estimated that US gross domestic product would be 0.75% to 1% lower and that credit spreads in the high-yield sector could widen from below 400 basis points to over 700 basis points.

The global uncertainty triggered by the United States' new confrontational trade policy has already been reflected in the development of world trade. Trading volumes have been declining since the middle of the previous year – a trend that has accelerated further in recent months (see Fig. 4).

In response to the tariffs levied against China, a reconfiguration of global value chains is already emerging. Vietnam in particular appears to be profiting from the withdrawal of production capacities from China. In addition, Taiwan, Chile, Malaysia and Argentina are enjoying an increase in direct foreign investment.

There is also the danger that the next step in the escalation will be for the US administration to extend its confrontational trade policy to Europe, where the Americans cite the automobile sector as a particular thorn in their side.

Fig. 4

Rate of change in the volume of world trade year-on-year

Collapsing inflation expectations underscore the vulnerability of the global financial system

Another motivation for monetary policy to throw all normalisation efforts out of the window could be the development of inflation expectations. After a temporary recovery over the first quarter, these have collapsed dramatically in recent weeks. For example, the break-even inflation rate for German government bonds fell to its lowest level since 2016, while the break-even rate for ten-year US Treasuries recorded a multi-year low of 1.6% (see Fig. 5).

One exception is the UK, where inflation expectations remain close to 3.5%. However, this is probably largely due to concerns about the inflationary consequences of a no-deal Brexit looming on the horizon.

The sharp correction in the oil price in May is also not a sufficient explanation. On the contrary, it seems that, in combination with the trade conflict, the US Federal Reserve's efforts at normalisation are threatening to suffocate the world economy. This underscores the vulnerability of the global financial system with its high level of indebtedness caused by only a moderate increase in funding costs and a stronger US dollar.

However, proclaiming the death of inflation, as the magazine Bloomberg Businessweek did in a cover story in April, may turn out to be premature, if not a contrary indicator over the longer term. The zeitgeist is changing and seems to be going in an inflationary direction. Warnings about over-indebtedness and budget deficits as well as warnings about more austerity have largely fallen silent. In return, radical theories such as "Modern Monetary Theory", which question the established separation of monetary and fiscal policy, have suddenly become socially acceptable; they not only find a platform in leading press outlets, but have even become the subject of parliamentary debates. The days of disinflation and deflation that lasted since the early 1980s may therefore be numbered and could herald a regime that in some respects is more reminiscent of the inflation dynamics of the 1960s and 1970s.

Fig. 5

Collapse of inflation expectations after temporary recovery in the first quarter

Taking a short-term perspective, it should also not be forgotten that the looming further escalation of the trade war will also have an inflationary effect.

Unexpectedly strong dollar while EM currencies remain weak

After a year marked by the continued strength of the US dollar – not just against the currencies of most developed countries, but also still significantly stronger against the developed countries – there were signs for 2019 that the dollar's high would come to an end. In particular, the prospect of a gradual normalisation of key interest rates in the Eurozone supported expectations of a convergence of interest rate differentials.

Since then, a reduction in the EURUSD interest rate differential has actually moved closer, albeit from a different direction than expected as a result of the turnaround in U.S. monetary policy. Nevertheless, the US dollar continued to stay strong (see Fig. 6).

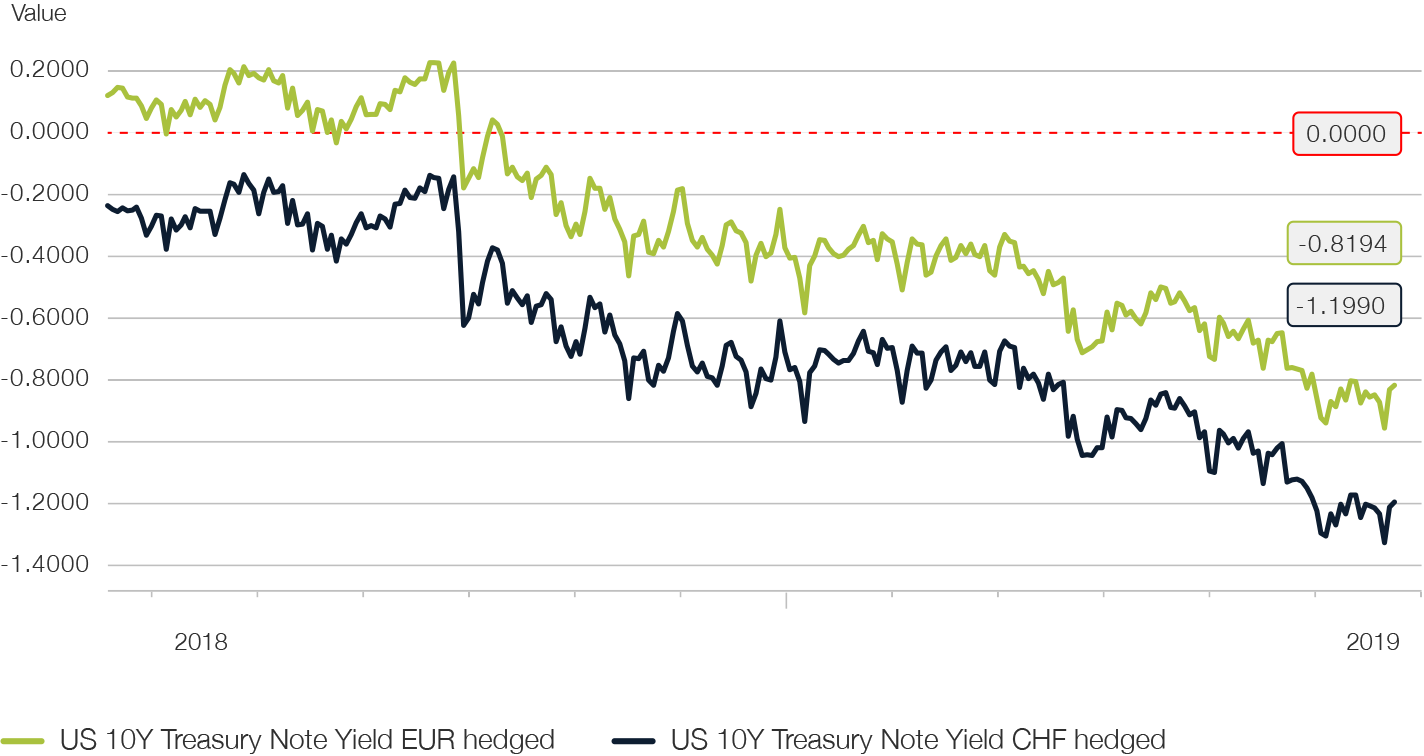

One driving factor for this could be the shortage of dollar funding due to a reduction in the dollar supply from currency hedging transactions by investors outside the dollar zone. For years now, they have been suffering from a steady rise in hedging costs, which have now exceeded the threshold of 3% per annum for the Euro, the Japanese yen and the Swiss franc. Conversely, this means that, after cost deductions, investments in dollar-denominated bonds are now producing significant negative yields, which is increasingly prompting such investors to refrain from hedging currency risk (see Fig. 7).

Nevertheless, we expect the US dollar to weaken gradually in the second half of the year, given the scale of the expected interest rate cuts, which the ECB and the Swiss National Bank will not be able to keep pace with given the lack of room for manoeuvre.

Fig. 6

Distinct divergences on the FX markets as a result of US monetary policy: Broad and narrow trade-weighted US Dollar vs. emerging market currencies

On average, the currencies of the emerging markets have not lost further ground against the US dollar in the current year, but they have not managed to recover either. This is because many emerging market economies continue to be burdened by declining capital inflows.

The escalation of the trade conflict has also left its mark on the FX market. In addition to obvious victims such as the Chinese yuan, AUDJPY is a currency pair that is even better suited as an indicator for the assessment of the currency market for the further development of the conflict. The Australian economy is particularly exposed to China due to its commodity focus and geographical location, while the Japanese currency has always been an effective barometer of risk aversion in the global capital markets due to its defensive character. This indicator does not yet provide any signs of an all-clear.

Fig. 7

Ten-year US government bonds with currency hedges in Euro and Swiss francs produce declining yields

Share Insight

Legal disclaimer

Picard Angst MEA Ltd. is a Private Company, established in Dubai International Financial Centre (‘‘DIFC’’) and regulated by the Dubai Financial Services Authority (‘‘DFSA’’). DFSA regulated firms are subject to Client Classification requirements and not all services and or products promoted may be suitable for Retail Clients under the DFSA rules and regulations. You are encouraged to seek independent financial advice as to your classification before entering into any transaction with the firm. This material is intended for use only by a Professional Client or Market Counterparty, as defined by the DFSA Client Classification requirements. This information is not intended for, should not be relied upon by, nor distributed to Retail Clients. Professional Clients may not be afforded the Retail Client protection and compensation rights that may generally be available to them from within the DFSA and other jurisdictions. For further information please contact: Picard Angst MEA Ltd., principal place of business: DIFC, Office No. 2008, Level 20, Emirates Financial Towers, South Tower, PO Box 506935, Dubai, United Arab Emirates.

© Picard Angst MEA Ltd.

Picard Angst MEA Limited

Emirates Financial Towers, South Tower, Office 2008, DIFC, Dubai, U.A.E. PO Box 506935

Telephone: +971 (0) 43785111. Email: info@picardangst.com, Web: www.picardangst.ae