2. Equity Markets

Selectivity opens up new opportunities

Dr. David-Michael Lincke, Head of Portfolio Management

In brief

- Global equity markets are still ignoring the gathering clouds, but a slowing of earnings prospects worldwide and EM underperformance call for caution.

- Distinct valuation divergences between regions and countries call for selectivity from investors but also open up opportunities. In addition to emerging markets, the medium- and long-term return prospects are also attractive for parts of Europe.

- The underperformance of value stocks against growth stocks, which has now persisted for almost a decade, is puzzling; however, it suggests a buying opportunity in the medium term.

- The US stock market is threatening to become the victim of its own success: its high outperformance compared to the rest of the world comes with the downside of excessive valuations, which makes us keep our distance.

- Despite the many structural headwinds, the hurdle for positive surprises in European equities is low.

Outlook

The nonchalance with which the stock markets have so far shaken off the economic risks and climbed to new highs is astonishing. However, the gradual deterioration in economic indicators worldwide and the resulting deterioration in corporate earnings prospects suggest that this is not a sustainable development and that a more challenging second half of the year can be expected. As risk aversion increases, the pronounced valuation differences between regions and countries are likely to have a greater impact. This calls for selectivity on the part of investors. In the medium and long term, emerging markets in particular offer attractive return prospects – but Japan and parts of Europe also appear interesting. US equities, on the other hand, should be avoided. Not only are they extremely expensive to value, but the high weight of the technology sector also increases the risk. Europe, on the other hand, appears favourable, but has to contend with structural and political headwinds on various fronts. We therefore continue to advise against a bargain hunt in the banking sector, and a commitment to the badly–battered automobile manufacturers seems premature. On the other hand, buying opportunities are tempting in Great Britain if one is willing to accept the continuing uncertainty surrounding the coming Brexit.

Comment

Global equity markets are still ignoring the gathering clouds, but a slowing of earnings prospects worldwide and EM underperformance call for caution

While excessive pessimism and fears of recession had caused the equity markets to suffer double-digit share price losses at the end of the previous year, the picture changed abruptly at the turn of the year. What initially looked like a purely technically driven counter-movement found additional underpinning with the US Federal Reserve's change of direction. However, the fact that at least the OECD equity markets have not only shaken off consistently weaker economic data but even the hardening trade conflict between the United States and China raises doubts that the new mid-year index highs will be sustainable (see Fig. 8).

Fig. 8

Development of selected equity markets in 2019

Source: Bloomberg LP, 2019

Even though the global average valuations are reasonable with a price-to-earnings ratio of around 15 and a dividend income of 2.9%, companies' earnings prospects are anything but promising. After a weak earnings period in the first quarter, particularly in the United States, corporate earnings growth will likely continue to cool off in the coming months. While the consensus among the analyst community had originally assumed 7%, expectations for the year as a whole have now shrunk to around 3%.

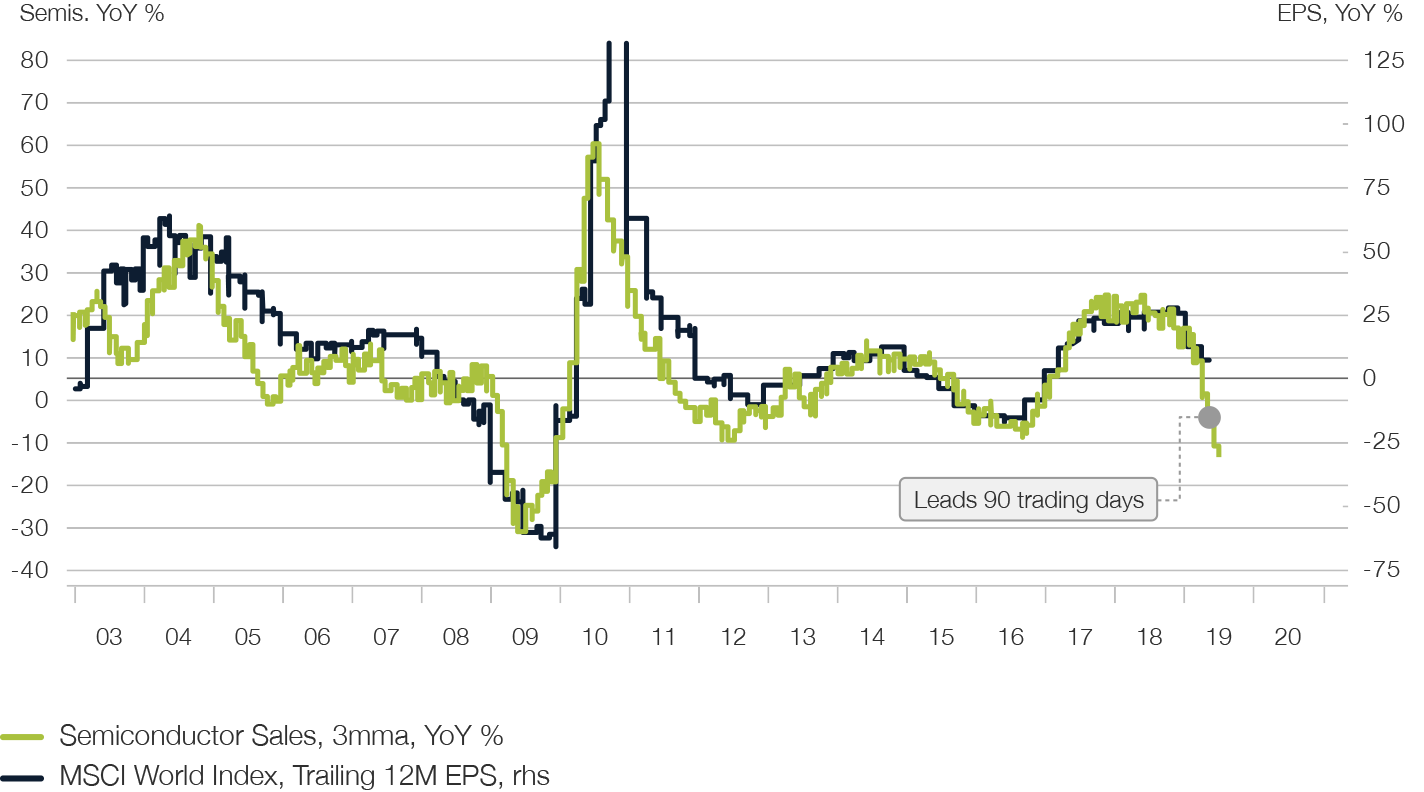

Companies' profit margins are also still under pressure. And it could get a lot worse. As semiconductors are playing an increasingly important role – not only in specialised technical equipment, but also in a wide range of products – sales in the semiconductor industry have not only become a reliable early indicator of economic growth and consumer demand, but also of the global trend in corporate earnings since the 1990s. The decline in semiconductor sales that has already been observed for a year has accelerated in recent months and, taking into account the lead time of a quarter, suggests that the stock markets are heading for a global earnings recession (see Fig. 9).

Fig. 9

Poor earnings prospects: In the past, semiconductor sales have proven to be a reliable early indicator for the development of global corporate profits

This also explains the persistently subdued-to-negative investor sentiment regarding equities, which is reflected in sustained outflows from equity funds despite new highs. In the United States alone, these have totalled around USD 120 billion since the beginning of the year, the worst year since 2008 and 2016.

The companies themselves have jumped into the breach as buyers. Share buybacks fed by tax savings, repatriated capital and continued favourable financing conditions in the capital markets have set new volume records in the United States. A study by the Ned Davis Research postulates that without this support, the US stock market would be 19% lower than the S&P 500 index.

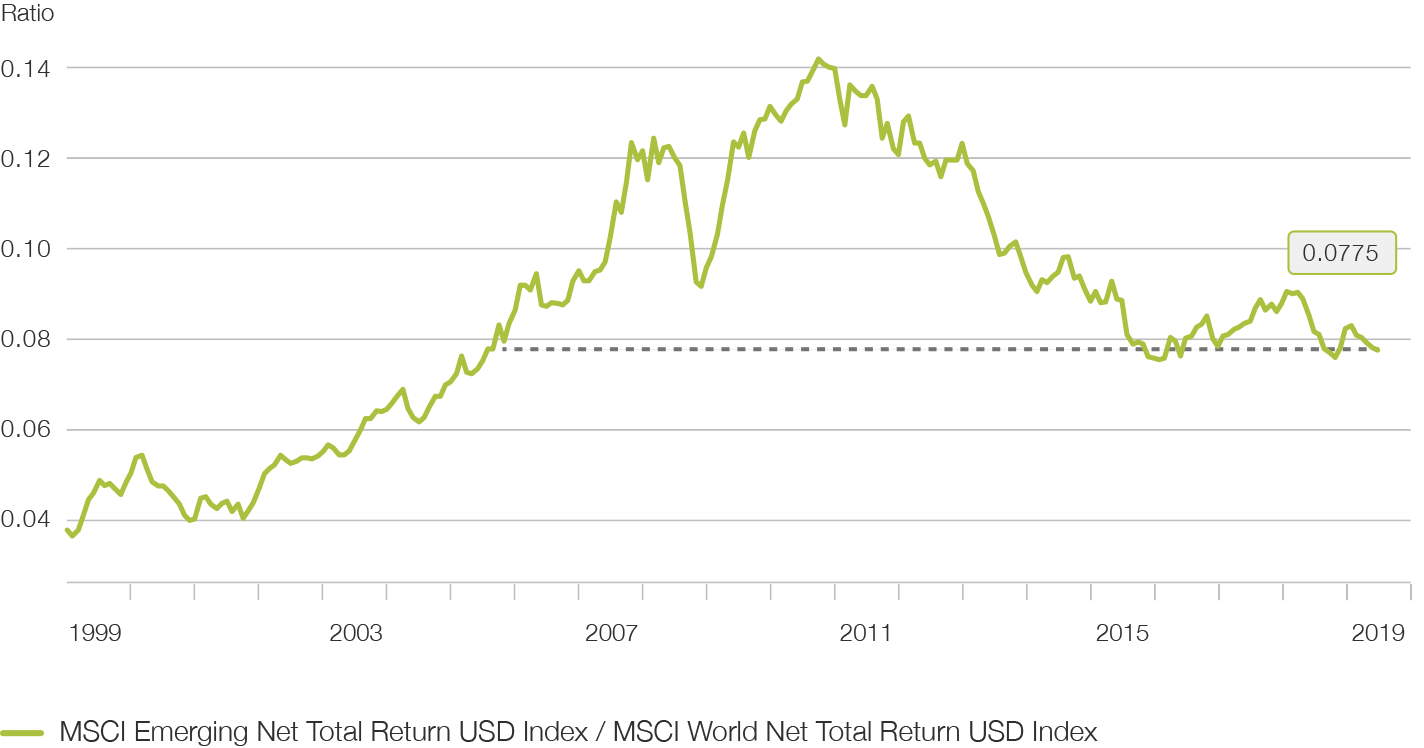

It is striking how clearly the equity markets of the emerging countries are lagging behind most of the developed equity markets this year (see Fig. 8). The emerging economies are much more exposed to the dynamics of world trade. It is therefore not surprising that this underperformance has continued to accentuate over the last two months since the collapse of the US-China negotiations. However, given the sustained higher growth rates in these parts of the world, it is surprising that the emerging markets have been experiencing a relative weakness in performance for almost ten years. Emerging market equities have now surrendered all the outperformance they had achieved since 2005 (see Fig. 10). Conversely, this has also accentuated the valuation advantage for companies in these regions, which raises medium- and longer-term return expectations significantly above the OECD average (see below).

Fig. 10

Emerging markets vs. industrialised countries: cumulative outperformance since 2005 surrendered

Distinct valuation divergences between regions and countries call for selectivity but also open up opportunities

If the earnings trend deteriorates, it can be expected that investors' risk aversion will increase. This normally leads to a sharpened awareness of valuations, which is why we expect an increasing dispersion of returns between individual regions and countries in the further course of the year.

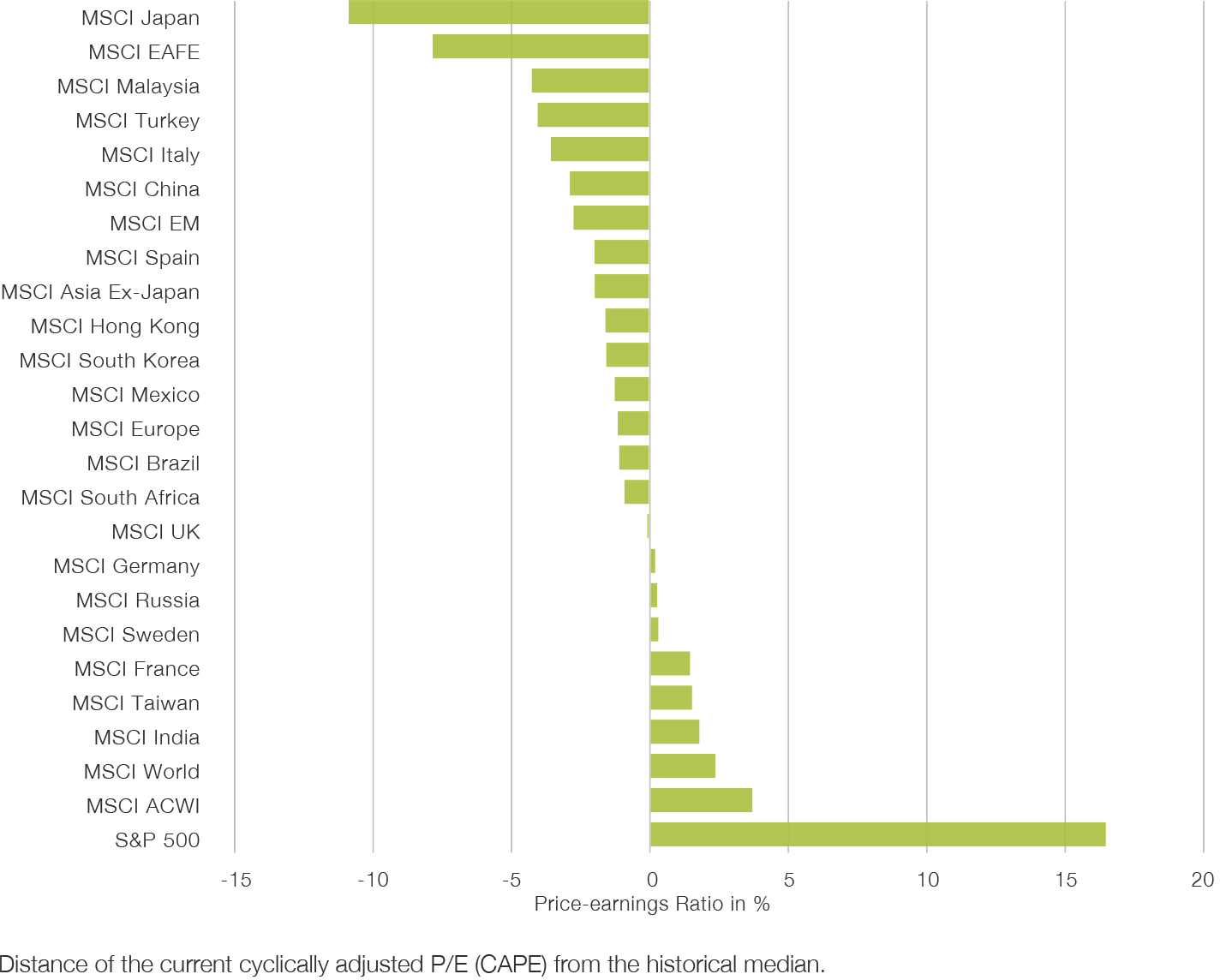

Taking a valuation yardstick such as the cyclically-adjusted price-to-earnings ratio (commonly referred to as the Shiller P/E ratio) as a basis – which has proven its worth with regard to its forecasting power over longer time horizons – a picture emerges of an unusually high spread in valuations, not only between industrialised and emerging countries but also within the block of OECD countries. This becomes particularly clear when analysing the differences between the valuations of the individual markets and their long-term historical median (see Fig. 11).

Fig. 11

Extreme overvaluation in the United States, but enticing bargains in emerging markets and parts of Europe

From this perspective, Japan proves to be our favourite. Even though the economy is suffering from a slowdown of exports, equity valuations not only remain attractive on a relative basis, but also on an absolute basis. Of all the industrialised countries, Japanese equities are valued by most favourably by far. The low indebtedness of Japanese companies is another argument: On average, the ratio of net indebtedness to EBITDA is 1.48%, which is lower than in the other industrialised countries. In addition, the Japanese central bank continues to pursue an extremely loose monetary policy.

Europe disappointed again: the first full year of rising corporate profits in 2017 after six lean years now threatens be a flash in the pan. Although the region's economy has improved slightly and equity valuations are not overpriced overall, there are a range of economic and political challenges (Brexit, Italy, France), monetary support has dried up and any headroom as regards monetary policy (despite ECB representatives' assurances to the contrary) is largely depleted. This calls for an overall neutral attitude and selectivity.

If Italy were to adopt a sustainable solution to its debt situation, this would greatly enhance the attractiveness of the country's listed companies, especially as no other European country has such low company valuations. Other austerity-struck Southern European markets, such as Spain, also offer opportunities. France, on the other hand, is particularly to be avoided. Although the Swiss equities market is among those valued comparatively highly, it is nevertheless likely to perform better than the European average in the coming year given its defensive qualities.

After the sharp price losses they suffered over the past year, emerging market equities appear particularly attractive. Thanks to China and others, economic activity in the emerging markets is developing better than in the industrialised countries. The significant valuation discount compared with the developed equity markets also count in their favour; this now reflects a good portion of risks posed by trade conflicts, to which the emerging markets are particularly exposed due to their export-driven nature.

The currencies of the emerging markets have lost a lot of ground, but have been showing signs of bottoming out for some months now and are trading significantly below value. Prospectively, they are likely to benefit from the change in monetary policy in the United States, which will lead to a gradual weakening of the US dollar and remove incentives for capital flight.

In addition, many investors are still cautious when it comes to the prospects of the emerging markets as a whole. In our view, this should be seen as a counter-indicator that suggests upward potential.

The most important submarket and driver for the emerging markets is and remains China, in both a positive and negative sense. Much will depend on the success of China's recently intensified efforts to set reflation impulses with fiscal and monetary policy measures. However, other Asian markets such as Malaysia also appear attractive from a valuation point of view.

A buying opportunity for value stocks against growth stocks is in the offing in the medium term

One phenomenon that has shaped the overall recovery and economic expansion since the global financial crisis is the sustained worldwide underperformance of value stocks (value factor) against growth stocks (growth factor) (see Fig. 12). What is striking here is that this situation is largely limited to the segment of highly capitalised companies.

Fig. 12

The long-term underperformance of value stocks against growth stocks continues

A similar situation recently arose during the internet bubble around the turn of the millennium. Back then, there was a speculative mania in individual areas of the technology, media and telecoms sectors, which asset-focused investors had to sit out. At the same time, however, value stocks performed quite well in absolute terms. This time, however, value stocks continue to depreciate despite low valuations. The overall profit growth of these companies did not disappoint. Therefore, the segment's neglect cannot be attributed to the spread of value traps, which remain cheap for good reasons.

A mixture of different influencing factors is likely to have contributed to this marked divergence in the current cycle. The extent to which disruptive technologies and business models have transformed established industrial structures in the technology, tourism and transport sectors, but also in the retail trade, and contributed to a 'winner takes all' dynamic in view of strong network effects, is obvious. The resulting concentration process has encouraged the rise of large monopolistic providers at the expense of established structures. The trend towards passivation and thus indexation of investments resulted in additional strengthening of the momentum and growth factor. Added to this was the relatively sluggish recovery of the real economy in the current expansion cycle compared with the stock market trend.

Although it is advisable for investors to weigh factors in the portfolio more highly when they are low-valued, valuation alone is not sufficient reason to anticipate a trend reversal. A number of conditions will probably have to be met, at least in part, before a sustained revival of the value factor can be expected on the equity markets. These include a stricter regulatory regime that does not shy away from breaking up monopolistic structures – such as those that have developed in the case of internet companies – as well as saturation of the trend towards investment passivation and thus stabilisation of the volume of actively managed investments, which traditionally have a value focus. A reduction in uncertainty regarding the economic outlook and an acceleration of the global economy would also be beneficial. But even a reset of the current cycle in the course of a recession could be suitable to bring about corresponding repricing of the risk premiums.

Against this backdrop, and given the extent to which the underperformance of the value factor has taken hold, we assume that their days are numbered and that investors are well advised not to take equities off the radar.

US equities – Falling star with outstanding track record

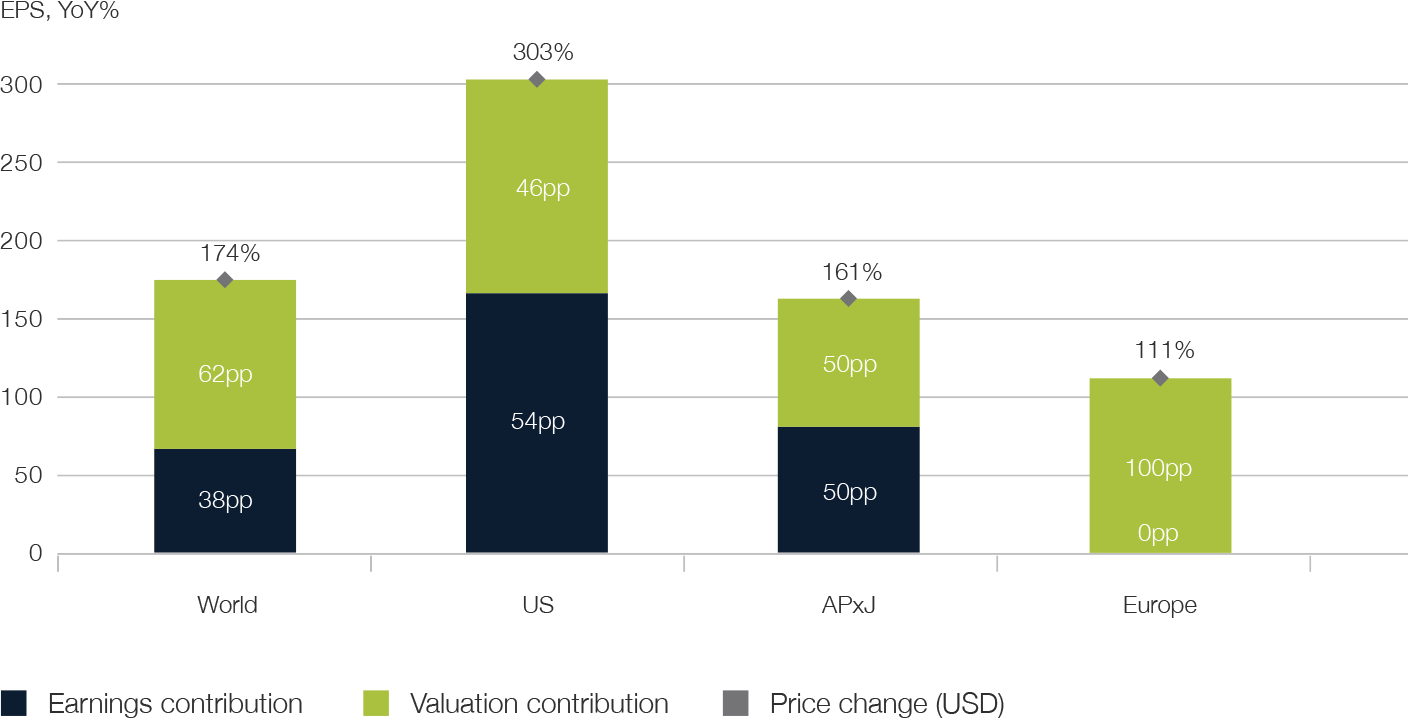

Over the last decade, the American stock market has left the rest of the world in the dust. While the S&P 500 and MSCI USA benchmarks have reached new highs, the rest of the world – measured by the MSCI ACWI ex-US Index – is in a sideways consolidation (see Fig. 13).

However, only half of the high performance was underpinned by rising corporate earnings, which is now reflected in an impressive valuation premium against the rest of the world and is weighing on the prospective return prospects (see Fig. 11).

In the meantime, the one-off effects from the reform of corporate taxes, which catapulted profit growth to 23% in 2018, are a thing of the past. But even the profit growth expectations of a mere 7% for the current year have now shrunk to only 3%. This implies a recovery in the second half of the year, however. According to FactSet, US corporate profits fell by -0.5% in the first quarter. A significant gap has opened up between multinational groups and companies focused on the domestic market.

Fig. 13

Hardly any recovery for the rest of the world, while US equities scale new heights

While the latter recorded moderate profit and sales growth, the former saw profits fall by more than 12%, with stagnating sales. In addition to the stronger US dollar compared to the same period last year, this also likely to be a consequence of the trade war. An earnings recession with two consecutive quarters of falling profits remains a real scenario for the US equity market.

The US market appears all the less attractive if one considers its high valuation and its disproportionately strong focus on cyclical industries. This cyclical orientation is more pronounced than in any other major market, with the exception of Japan, and this market is more exposed than emerging markets to cyclical sectors for the first time in its history.

Technology stocks – which almost twenty years after the internet bubble have become the driving force behind the US stock market again – are a particular cause for concern among cyclical stocks. Their share of market capitalisation now stands at over 25% – a level that was only crossed once before for a short time in 2000, before the speculative bubble burst. The dependence of the broad equities market on the fate of the technology sector is thus currently higher than ever before.

For a long time, investors have ignored the potential risks of the trade war on technology stocks. This has now come back to haunt them. The fact that the US government has blacklisted Chinese companies such as Huawei is raising the spectre of a new technological Cold War and illustrates how susceptible companies in this sector are to sudden restrictions. Due to the close interdependence of the value chains, the consequences can be felt throughout the entire global value chain. US semiconductor stocks have fallen 15% from their peak and are now back at the same level they were a year ago.

The risk represented by the technology sector for the broad equity market is by no means limited to a potential clouding of the course of business. The high sector concentration is particularly the result of the strong positive network effects that characterise many of the business models; the positive externalities promote a winner-takes-all dynamic whose natural end result is the establishment of monopolies. Although the interpretation of antitrust law in the United States has become much more cautious since the Reagan era, the fact that the reach of advertising and social media platforms has now entered the political sphere and even influenced the outcome of elections has provoked a potentially far-reaching political reaction. Even if the destruction of monopolistic structures were to be halted, alone the introduction and enforcement of more stringent regulation to protect private data sovereignty and privacy could severely affect the business models of the technology giants. The US Department of Justice's recent announcement of an antitrust investigation into Google's parent company Alphabet underscores the seriousness of this risk.

With regard to portfolio positioning, this indicates a significant underweighting, if not elimination, of the exposure to US equities. The extent of the valuation divergences also makes currency-neutral, market-neutral long-short combinations appear attractive, especially with regard to Japan, the emerging markets and Europe.

Low hurdle for positive surprises in European equities

The fact that European equities have posted by far the weakest performance among the world's major regions over the past decade is owed not least to the fact that corporate earnings have stagnated overall during this period (see Fig. 14).

Fig. 14

With the exception of Europe, the previous decade's stock market performance of the was driven to a large extent by corporate earnings growth

After repeated disappointments, and in the face of constant headwinds from political and structural factors, expectations of the European stock market have been relativized over the past few years. Valuations are correspondingly low, especially in the peripheral states of the European Union. Also, unlike in the United States, the danger of a profit recession does not appear acute. The hurdle for positive surprises in European equities is therefore low.

However, the prices of defensive stocks such as utilities, pharmaceuticals and consumer staples, which are currently very attractive to investors in view of the shaky economic outlook, are already reflecting respectable premiums.

From a valuation point of view, the European automotive sector seems particularly interesting. However, it is still suffering from a sharp drop in sales. Patience is likely to be required here, as a sustained recovery in share prices in this area requires a brightening of the economic outlook.

Most European banks are valued even lower and only traded at a fraction of their book value (see Fig. 15). They have sat out the recovery of the broad stock market since the beginning of the year. The extremely low valuations show that market participants have lost faith in the reported balance sheet value. Paradoxically, it is not least the continuing extremely loose monetary policy, which is actually intended to support the European economy, that is depressing the profitability of the banks. The failure of high-flown merger plans, such as those between Deutsche Bank and Commerzbank, as well as similar thought experiments in the French and Italian banking systems, makes it clear that the problems cannot be solved by simply concentrating and forming larger units. Instead, long-deferred deep cuts in the form of rigorous recapitalisations and the painful realisation of protracted losses will be needed to recover the banking system. For these reasons, we advise following the siren call of low valuations in this case.

Fig. 15

The ailing European banking sector still awaits a solution

Although or precisely because they are shaken by the prevailing uncertainty regarding the shape of the upcoming Brexit, British equities appear attractively valued. This is owed not least to the fact that companies in the leading FTSE 100 index generate most of their turnover outside their homeland. A favourable currency, low valuations and the fact that the economy has so far managed to weather the political storms are all reasons for an overweight in British equities.

Special

Factor premiums as a source of return

Mario Tinnirello, Head of Systematic Strategies

Academic research has identified and documented various factors that can be used to achieve a positive return and whose return potential is not justified by additional risks.

Individual portfolios constructed on the basis of these factors are already successfully implemented in the long term, such as value strategies (value factors), small-cap strategies (size factors) or quality strategies (quality factors). Although these types of factor strategies have the potential for an excess return over time, the premiums fluctuate significantly in the short term and phases of lower returns may occur.

Thanks to the low correlation of different factor groups, a combination of different factors (value, quality, momentum, growth) can counter this problem and a robust and stable approach can be developed.

In many cases, factor returns are justified by certain anomalies arising from information processing (behavioural finance, over- or underreaction to information).

The momentum criteria and the quality criteria achieved the highest premiums globally. Shares with a clearly positive/negative price development in the past also achieved a clearly positive/negative price development in the period under review. Equities with above-average qualitative characteristics also achieved above-average performance.

Switzerland also showed a strong development of momentum factors and a correspondingly high premium in the first half of the year. After a partial decoupling of the price development from fundamental criteria in the first quarter, the value criteria in particular made a high contribution in the second quarter.

In the first half of the year, a positive premium was observed in all factor groups (value, quality, momentum and growth). The combination of the factors in a multi-factor approach achieved a correspondingly high premium, which even exceeded the long-term average.

Factor premiums long-term and 2019

With our systematic investment strategies, we offer investors access to equity investments which, in addition to the classic market return, integrate other return drivers and thus represent an alternative to passive investment strategies while still being implemented in a transparent and rule-based manner.

This enables investors to participate in sources of returns that cannot be tapped using purely passive approaches. With our systematic approach, we take account of a large number of quantitative factors, which efficiently evaluate fundamental data, price data and analyst estimates and incorporate them into portfolio construction. The strategies are theoretically sound, comprehensively tested and implemented in a disciplined manner.

Share Insight

Legal disclaimer

Picard Angst MEA Ltd. is a Private Company, established in Dubai International Financial Centre (‘‘DIFC’’) and regulated by the Dubai Financial Services Authority (‘‘DFSA’’). DFSA regulated firms are subject to Client Classification requirements and not all services and or products promoted may be suitable for Retail Clients under the DFSA rules and regulations. You are encouraged to seek independent financial advice as to your classification before entering into any transaction with the firm. This material is intended for use only by a Professional Client or Market Counterparty, as defined by the DFSA Client Classification requirements. This information is not intended for, should not be relied upon by, nor distributed to Retail Clients. Professional Clients may not be afforded the Retail Client protection and compensation rights that may generally be available to them from within the DFSA and other jurisdictions. For further information please contact: Picard Angst MEA Ltd., principal place of business: DIFC, Office No. 2008, Level 20, Emirates Financial Towers, South Tower, PO Box 506935, Dubai, United Arab Emirates.

© Picard Angst MEA Ltd.

Picard Angst MEA Limited

Emirates Financial Towers, South Tower, Office 2008, DIFC, Dubai, U.A.E. PO Box 506935

Telephone: +971 (0) 43785111. Email: info@picardangst.com, Web: www.picardangst.ae