5. India

2020 – a year of recovery?

Chrys Kamber, Fund Manager – Head of Indian Investments

In brief

- Developments in India in the second half of the year were mainly characterised by slower GDP growth and difficulties in the financial sector. In the second quarter of fiscal year 2020, GDP growth was 4.5%, the weakest figure since the first quarter of the 2013 fiscal year.

- The Central Bank of India lowered the key interest rate by 35 basis points to 5.4% and announced that growth now had top priority.

- The government has withdrawn the higher ‘super-rich tax’ for foreign and domestic investors and grants startups exemptions from capital injection taxes.

- The corporate income tax rate has been reduced from 30% to 22%, which will reduce the effective tax rate for Indian companies from 35% to 25.17%; new manufacturing companies established after 1 October will be subject to a tax rate of 15%.

- In order to plug the budget gap, the government intends to sell the state's stake in three public sector companies.

- A capital injection of USD 9.8 billion into public sector banks is intended to improve lending to companies, non-bank financial institutions, micro, small and medium-sized enterprises (MSMEs) and private customers.

- White goods recorded higher sales (supported by e-commerce), while gold jewellery and car sales declined.

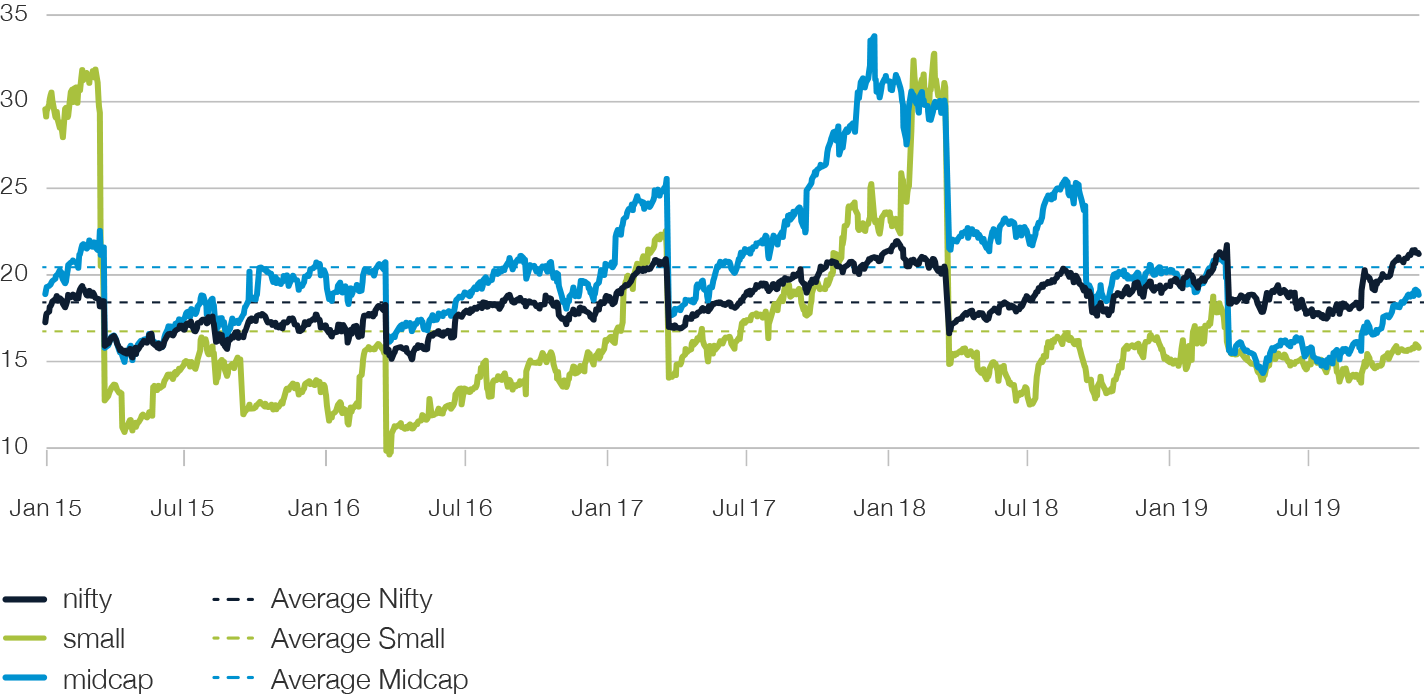

- The stock markets continued to be polarised; the general market was unable to keep pace with key stocks. Thanks to a handful of highly-weighted stocks, the Nifty climbed to record highs; however, small cap stocks fell victim to the weak growth.

- Whereas foreign investors sold Indian shares – net of dividends – in the middle of the year, they increased their holdings again from October onwards.

- The Nifty’s average price/earnings ratio has risen to its highest level in the last two decades, raising doubts about the valuation level.

Outlook

The government might review the tax on long-term capital appreciation that was introduced in April 2018 and lower personal income tax to stimulate the demand side.

The Central Bank’s accommodative monetary policy and a proactive, action-oriented government are key for a rapid recovery of the Indian economy.

The recapitalisation of public sector banks will strengthen lending, lower the cost of credit and improve the classification of banks' distressed assets.

Domestic capital inflows remained strong, reaching a seven-month high in November. Inflows into what are called systematic investment plans (SIPs) were constant at an average of around USD 1 billion per month.

Given that inflation remains subdued at less than 4.5%, the Indian central bank has sufficient room for manoeuvre for the sixth consecutive rate cut this year and a further cut next year.

A change in the strict labour laws and facilitation of land acquisition are currently under discussion. If parliament approves these laws in the winter, the mood should brighten massively.

Together with the Indian central bank’s accommodative monetary policy and the high savings capacity of households (as high as in 2012), a series of measures announced in recent months should stimulate demand in the next two quarters.

In view of the fact that the valuation gap between the large caps on the one hand and the mid/small caps on the other is at a ten-year high, money should slowly flow out of the safe havens of the large caps towards the mid and small caps. For some stocks, whose valuation has increased far too strongly, there will be a consolidation.

Comment

Weak growth – are we already in the recovery phase?

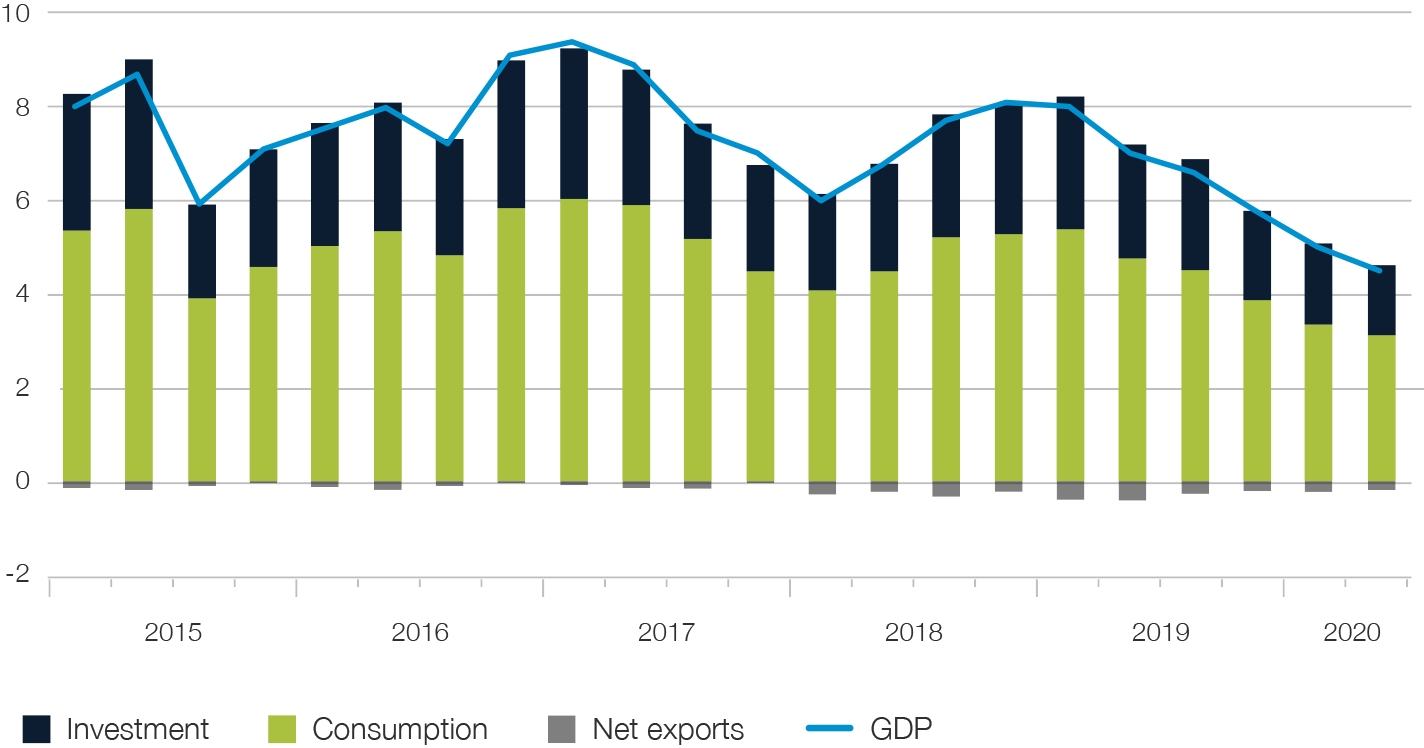

The slowdown in GDP growth was sudden, but not unexpected. While India still recorded impressive GDP growth of 9.4% in the first quarter of 2017, the country is now struggling to maintain growth above 5%. However, the market has already priced in the weak growth, with small and mid caps suffering the most. The overall market was affected by the abrupt decline in GDP growth, problems in lending, difficulties in the automotive sector and debt reduction in corporate balance sheets, as well as by asset declines due to increased tax liabilities and increased transparency in transactions.

Fig. 32

GDP growth

“In our opinion, this is now largely priced in. We expect the broader market to pick up in the first quarter of 2020 and growth from the second quarter of 2020.”

The slowdown in GDP growth was sudden, but not unexpected. While India still recorded impressive GDP growth of 9.4% in the first quarter of 2017, the country is now struggling to maintain growth above 5%.

There are several reasons for the slowdown in GDP since the first quarter of fiscal year 2017:

The demonetisation that took place in November 2016 led to job losses and a slump in demand with correspondingly severe effects on consumption. However, this measure has accelerated financial inclusion and increased the use of digital payment facilities.

The demonstration was followed by a further disruptive measure in the form of a reform of the goods and services tax (GST) in July 2017. Small companies that had previously benefited from the tax differences had to adjust their transactions and prove tax transparency – or even give up.

While the impact of these two disruptive events waned, the fact that IL & FS, one of the largest infrastructure financiers, stopped servicing its debt caused a liquidity crisis in September 2018. This default infected banks, property developers and companies with high debt ratios (e.g. Dewan Housing Finance Corporation (DHFL), Indiabulls Group and Anil Ambani Group).

Although liquidity returned in the first half of 2019 thanks to the measures taken by RBI, lending largely came to a standstill: Banks have almost stopped lending to non-bank financial companies. These are the most important lenders for MSMEs and consumers. When the banks reduced their loan commitments in these non-banking financial enterprises, financing for MSMEs became correspondingly more difficult. Lending to retailers and the property industry slowed and put an additional strain on property developers, who were already finding it difficult to refinance their debts. All these factors played an important role in weakening private investment and demand. On the other hand, government infrastructure spending came back on track in the run-up to the parliamentary elections. The weakness in industrial production is due to the slowdown in demand and the credit crisis. Although the credit business picked up in the second half of 2019, this development is limited to companies with good credit ratings and larger non-bank financial companies with healthy balance sheets.

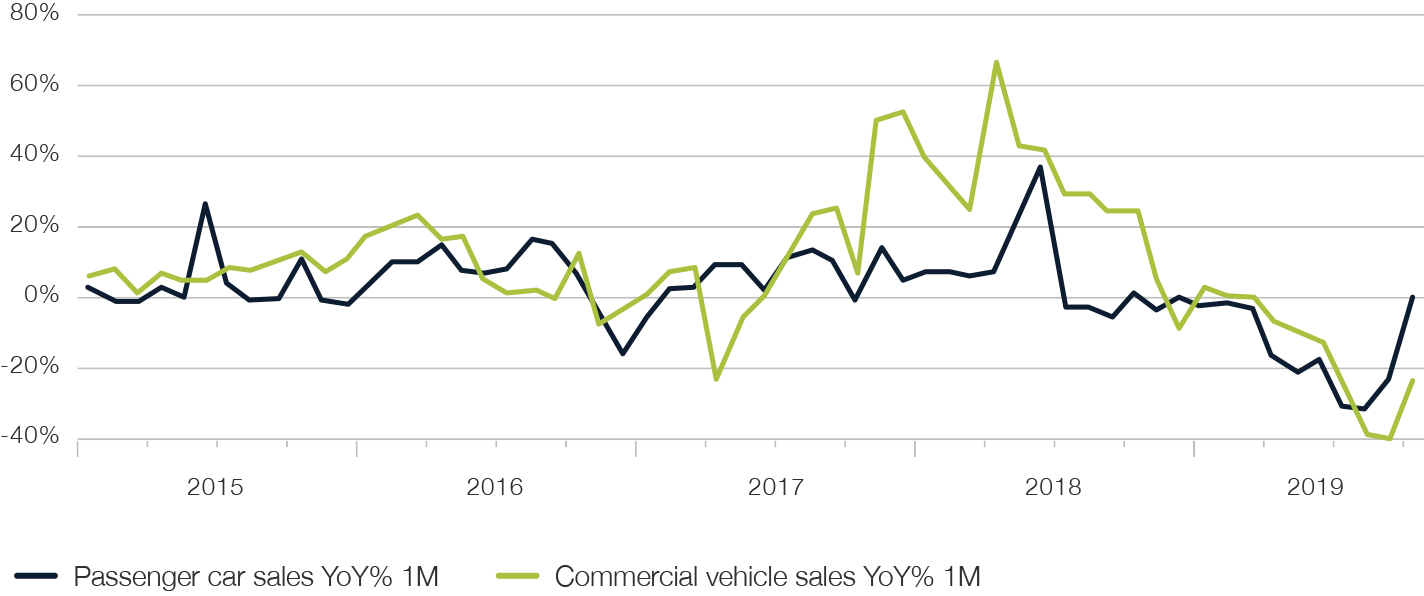

The automotive industry, which contributes 40% to the GDP of India's manufacturing industry, suffered massively. In the first quarter of the financial year 2020, sales of passenger cars and commercial vehicles fell by 23% compared with the previous year; in the same period, sales of two-wheelers, which reflect the economic development in rural areas, fell by 16%. This illustrates the difficulties of the urban and rural economy on the one hand, also the changed consumer behaviour of millennials on the other.

Fig. 33

Automobile consumption will recover in the second quarter of 2020 after a slump

The US has once again threatened higher tariffs on Chinese imports, and trade talks between the US and China took place in the second half of the year. For emerging markets, this led to greater volatility in both their currencies and their equity markets. India's share of world trade is only 2%. The effects of the trade war are very manageable for India, if not a blessing for the country.

The government is rapidly taking the right steps to put India on the global stage and increase its share of world trade. The Government has reduced the corporate income tax rate from 30% to 22%, which will reduce the effective tax rate for Indian companies from 35% to 25.17%. In addition, new manufacturing companies established after 1 October are subject to a 15% tax rate if they start production by March 2023. This measure was taken not only to improve business investment, but also to improve India's global competitiveness. The country wants to attract companies that are looking for alternative manufacturing locations (outside China) or want to diversify into other regions in view of the trade war. In the short term, this measure will improve the business climate; in the long term, it will contribute to the expansion of production capacities. Although the tax cut was initiated primarily on the supply side, it will also support demand in the medium term. Increased corporate profitability as a result of tax cuts will benefit equity valuations, creating wealth and in turn boosting demand.

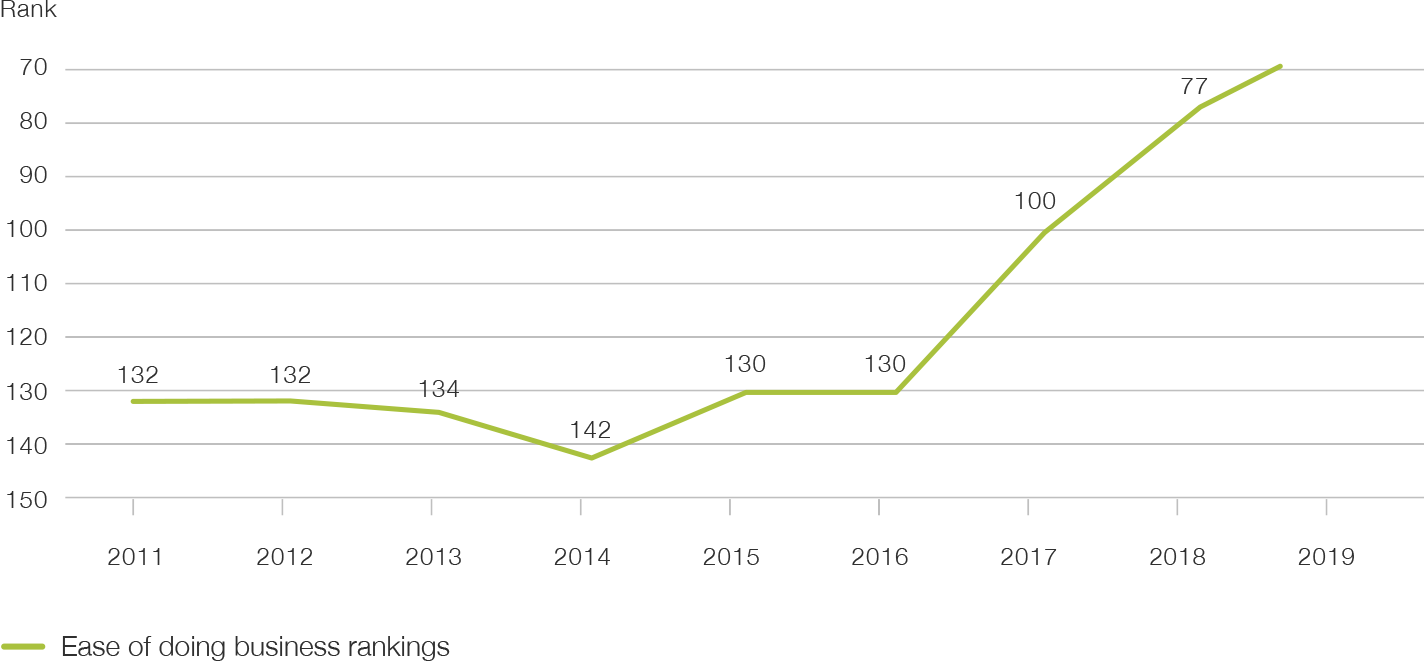

India has worked its way up to 63rd place in the Doing Business 2020 report, in which the World Bank analyses how easy or difficult it is to do business in the individual countries. Last year, India ranked 77th and the country has made considerable progress since then. Both the attractive tax environment and the improved business environment will attract foreign investment and encourage India to embrace global export business.

We will likely have to wait two more quarters before the government's measures to get India's economy back on track take full effect. The Central Bank of India cut interest rates by 135 basis points to 5.15%. However, only 29 basis points of the 75 basis points interest rate cut made in the second half of the year were passed on for new lending. Toll revenues rose by 6% from the end of October and then by 6% in November, offsetting the two-month decline in revenues from goods and services taxes. Investments from abroad have increased in the last two months. While these indicators cautiously suggest that the worst is behind us, further government structural reforms are needed to ensure that the burgeoning economic recovery is sustainable.

Small and mid caps will benefit from falling interest rates in the short term, as their interest costs will decrease. Market participants expect the next budget in February 2020 to include considered reforms. The reform of labour laws, the law on land acquisition and the reduction of personal income tax rates are also likely to be announced before then. The latter measure in particular should strengthen the demand side, as Indian consumers will have more money in their pockets. With the reform of the outdated labour laws and land purchase regulations, India's business environment will continue to improve and provide more flexibility for companies to manage their costs efficiently. The winter session of Parliament will have the privatisation of state-owned enterprises and major reforms in agriculture and mining on the agenda. Narendra Damodardas Modi has sufficient political capital to implement the reforms. We then expect a gradual, broad-based recovery in the second half of 2020. As equity markets tend to be ahead of developments, we could see an upward trend in the broader market at the beginning of next year. The risks for such a scenario are, for example, the default of a large company, a sudden jump in inflation, which calls into question the interest rate cut, a rise in oil prices or a rapid slowdown in the global economy.

Fig. 34

Both the reduction in the corporate tax rate and the significant improvement in the business environment will attract foreign investment to India

While hampering growth in the short term, enforcing more transparency in the Indian economy provides a basis for such reforms to have a long-term impact. After certain upheavals, the economy and companies are adapting to the new environment. India needed to reach a nominal GDP of about one trillion US dollars from 1947 to 2002. And although the currency has depreciated by around 13% in the last five years, India has been able to increase its nominal GDP by a further trillion US dollars over this period. Despite the short-term weakness in growth, the Indian economy has structural advantages: on the one hand, the demographic dividend as the basis for solid domestic demand and, on the other, the government's willingness to invest in infrastructure. A GDP of five trillion US dollars may not be achievable for India in five years, but it can be achieved in eight to ten. India offers a wealth of investment opportunities.

Fig. 35

RBI lowered the interest rate by 135 basis points to 5.15% in 2019

The dynamics of the Indian consumer market are changing – another disruptive development is on the way

Around 65% of the Indian population is younger than 35 years old. The unprecedented penetration of internet and smartphone technologies, social media and e-commerce is influencing the dynamics of the Indian consumer market. Millennials are technically proficient and very culturally diverse. They are becoming more and more influential and will change demand structurally. The 400 million people of India’s millennial generation make up 47% of the working age population and, accordingly, a large part of the Indian consumer base. They already account for 70% of household income and spend 330 billion US dollars a year (more than their parents). The consumer ecosystem is changing, and companies need to adapt their products and services. Millennials attach importance to quality, comfort, health/well-being and environmental/social aspects. Therefore, companies that are prepared for the rapid change of consumer needs and adapt their products and services accordingly will succeed. Other companies, on the other hand, will disappear from the market over time if they are unable to change their business model quickly. Millennials and Generation Z prefer companies whose products and services match their values. They will punish the others.

The first victims of this change are the gold jewellery and automobile sectors. Millennials prefer to buy electronic goods (comfort and well-being). This development can be clearly seen in the unprecedented sales figures for electronic household appliances during this year's festive season. Online retail is currently experiencing spending of 40 billion US dollars; by 2027, this volume is expected to reach 500 billion US dollars. The government has built infrastructure (roads, railways and airports) and has provided more and more citizens with affordable housing and electricity in the last five years.

Are small and mid caps about to make a comeback in 2020?

The stock market can behave irrationally for a long time. While the economy appears to be weakening, the Nifty is reaching an all-time high despite extremely high valuations. If you take a closer look at the Nifty, you can see that only a handful of highly-weighted large caps contributed to its performance, while the rest of its components were in the red. The largest losses were recorded in small cap stocks, as market participants are still seeking safe havens. Data on domestic investment funds show that around 78% of the total investments of investment funds and insurance companies are concentrated in the country's fifty leading enterprises, ultimately those in the Nifty 50.

The euphoria triggered by the reduction in corporate income tax will soon subside; reason and thus the view of fundamental data shall prevail. The market will soon realise that the high valuation of the large caps does not justify the low valuation of the remaining securities. Since the underperformance is totally exaggerated, it can reach tipping point at any time. Small and mid caps have suffered the most since January 2018; their price-earnings ratio has fallen sharply since then.

Fig. 36

The gap between SMEs and the Nifty Index is set to narrow in the first quarter of 2020

The risk premiums of small and mid caps compared with large caps have risen significantly. This development is the result of a significant underperformance of small and mid caps compared with the main stocks since their peak in January 2018; in addition, short-term volatility clouds the outlook. When planning their investments in equity funds, investors can follow what is known as the ‘core-satellite approach’.

Since mid-October, we have seen a moderate recovery in selected sub-securities and in securities that have come under pressure due to problems with corporate governance or payment defaults. It is only a matter of time before the prices of small and mid caps reflect the true intrinsic value of these companies.

Emerging markets will benefit from the globally accommodative central bank policy and negative interest rates, and India will be one of the beneficiaries of foreign capital inflows.

Share Insight

Legal disclaimer

Picard Angst MEA Ltd. is a Private Company, established in Dubai International Financial Centre (‘‘DIFC’’) and regulated by the Dubai Financial Services Authority (‘‘DFSA’’). DFSA regulated firms are subject to Client Classification requirements and not all services and or products promoted may be suitable for Retail Clients under the DFSA rules and regulations. You are encouraged to seek independent financial advice as to your classification before entering into any transaction with the firm. This material is intended for use only by a Professional Client or Market Counterparty, as defined by the DFSA Client Classification requirements. This information is not intended for, should not be relied upon by, nor distributed to Retail Clients. Professional Clients may not be afforded the Retail Client protection and compensation rights that may generally be available to them from within the DFSA and other jurisdictions. For further information please contact: Picard Angst MEA Ltd., principal place of business: DIFC, Office No. 2008, Level 20, Emirates Financial Towers, South Tower, PO Box 506935, Dubai, United Arab Emirates.

Any opinions, projections, forecasts or estimates in this report reflect only current views of the author and are subject to change without notice. Picard Angst MEA Ltd. has no obligation to notify a reader or recipient of this publication in the event that any matter, opinion, projection, forecast or estimate contained herein, changes or subsequently becomes inaccurate, or if research is withdrawn.

The investments referred to in this publication do not take into account the recipients suitability requirements or investment risk appetite. Recipients are urged to base their investment decisions upon their own appropriate investigations that they deem necessary. In the event of any doubt about any investment, recipients should seek independent investment, legal and/or tax advice regarding the appropriateness of any transaction.

Any loss or other consequence arising from the use of the material contained in this publication shall be the sole and exclusive responsibility of the investor and Picard Angst MEA Ltd. accepts no liability for any such loss or consequence. Please note past performance is not necessarily a guide to the future performance of an investment.

Picard Angst MEA Ltd. aims to be transparent, fair in business dealings and to adhere to DFSA conflicts of interest requirements. For further information please contact the Dubai office.

© Picard Angst MEA Ltd.

Picard Angst MEA Limited

Emirates Financial Towers, South Tower, Office 2008, DIFC, Dubai, U.A.E. PO Box 506935

Telephone: +971 (0) 43785111. Email: info@picardangst.com, Web: www.picardangst.ae