Annual outlook and commentary

The Tide Goes Out – Our Opinion

2018 was a year of change in the financial markets. Is the downturn continuing or are the negative special effects running out and are the prospects brightening, as here at the red lighthouse on Texel's North Sea beach? Photo: Olha Rohulya iStock

Practically all asset classes closed the turbulent 2018 financial year negative. Meanwhile, the global economy is proving robust. Against the backdrop of the normalisation of monetary policy, a challenging environment is emerging for 2019. David Lincke, Head of Portfolio Management, explains where the wheat separates from the chaff in our annual outlook and commentary.

Looking back, 2018 has turned out to be a year of trend reversal in financial markets. Over the first half of the year, the much-vaunted globally synchronised growth upswing ran out of steam and macroeconomic headwinds and political concerns began to dominate, whether in the form of escalating trade disputes, capital flight from emerging markets, weakening growth in China or the renewed sense of crisis on the EU periphery. Recently, even the American equities market has begun to waver, despite continuing robust economic growth.

Separating the wheat from the chaff

In the outlook for 2019, a much more challenging environment is emerging for investors than in recent years, which will be conducive to separating the wheat from the chaff. This is because the liquidity provided by monetary policy over the past decade in a globally coordinated form and to an almost unlimited extent is drying up. And, as Warren Buffet once aptly remarked: "Only when the tide goes out do you discover who has been swimming naked".

Active investment style required

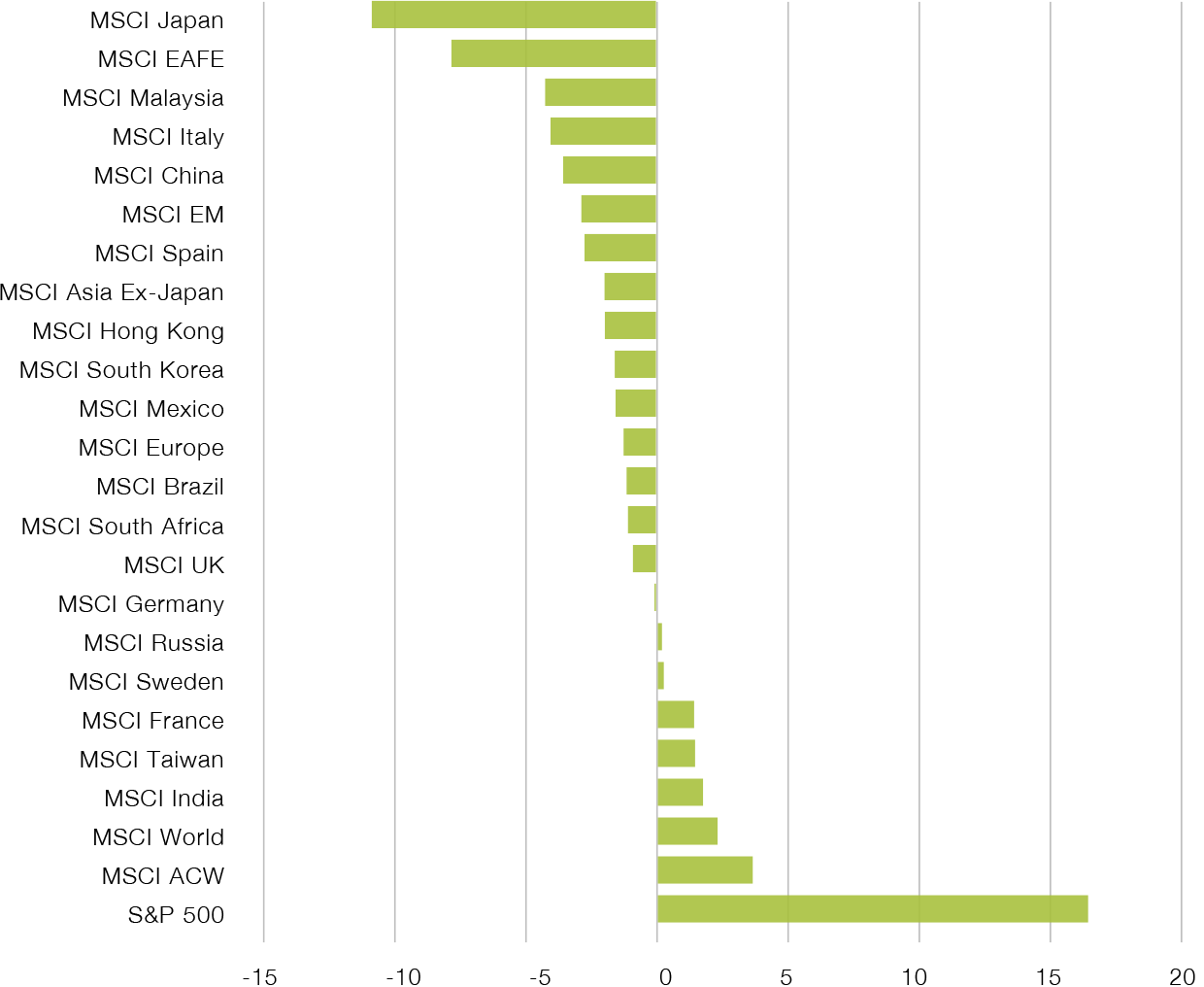

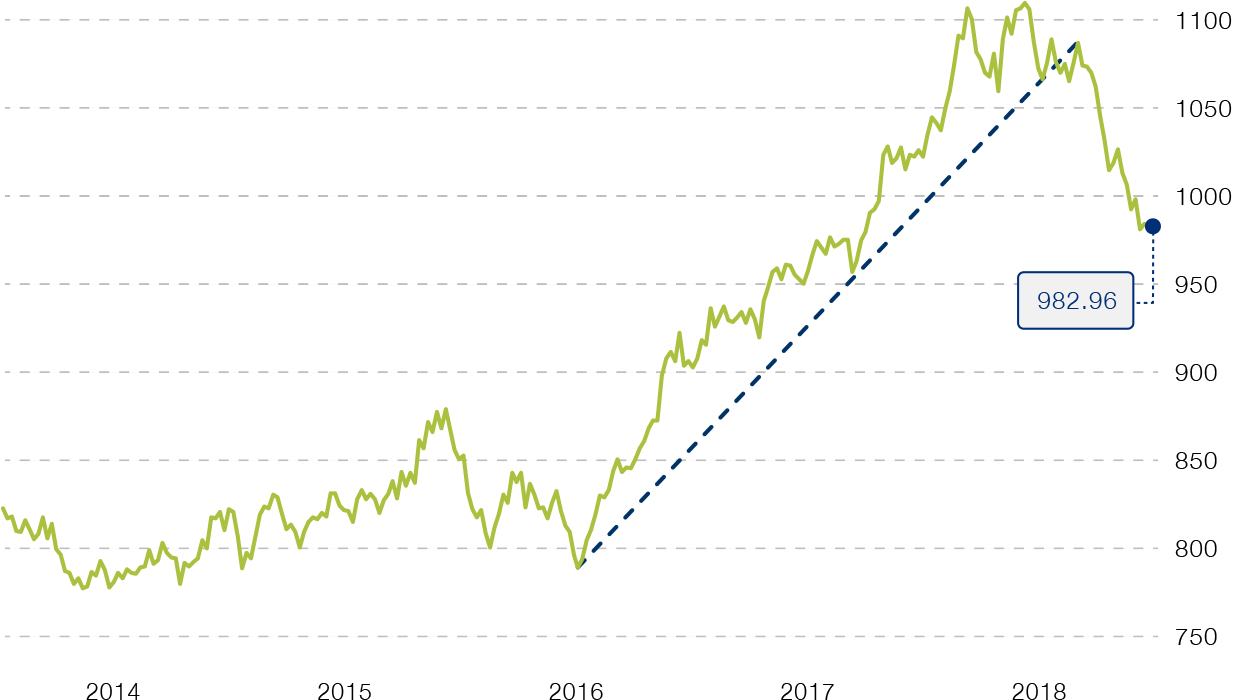

The return prospects for most asset classes are strongly reduced. A more active investment style and a high degree of selectivity will be required to achieve the targeted returns. In doing so, there is still no getting away from equities. Despite the fact that overall average valuations remain high, individual countries and sectors have already made significant corrections. In particular, the field of emerging markets, as well as one or another of Europe's equities markets, holds potential for recovery.

Equities

Global equity markets are reversing their trend in the face of corporate earnings that have peaked. Uncertainty about the geopolitical and macroeconomic outlook is reflected in sharp price fluctuations.

Opportunities are opened up by pronounced valuation differences between regions and countries. US equities, for example, are as unattractive as ever. This requires an active investment style and high selectivity. Defensive sectors in particular should be given preference over cyclical sectors.

Bargain lures in emerging markets

The recovery of defensive stocks only at the beginning

Sovereign Bonds, Money Markets and Credit

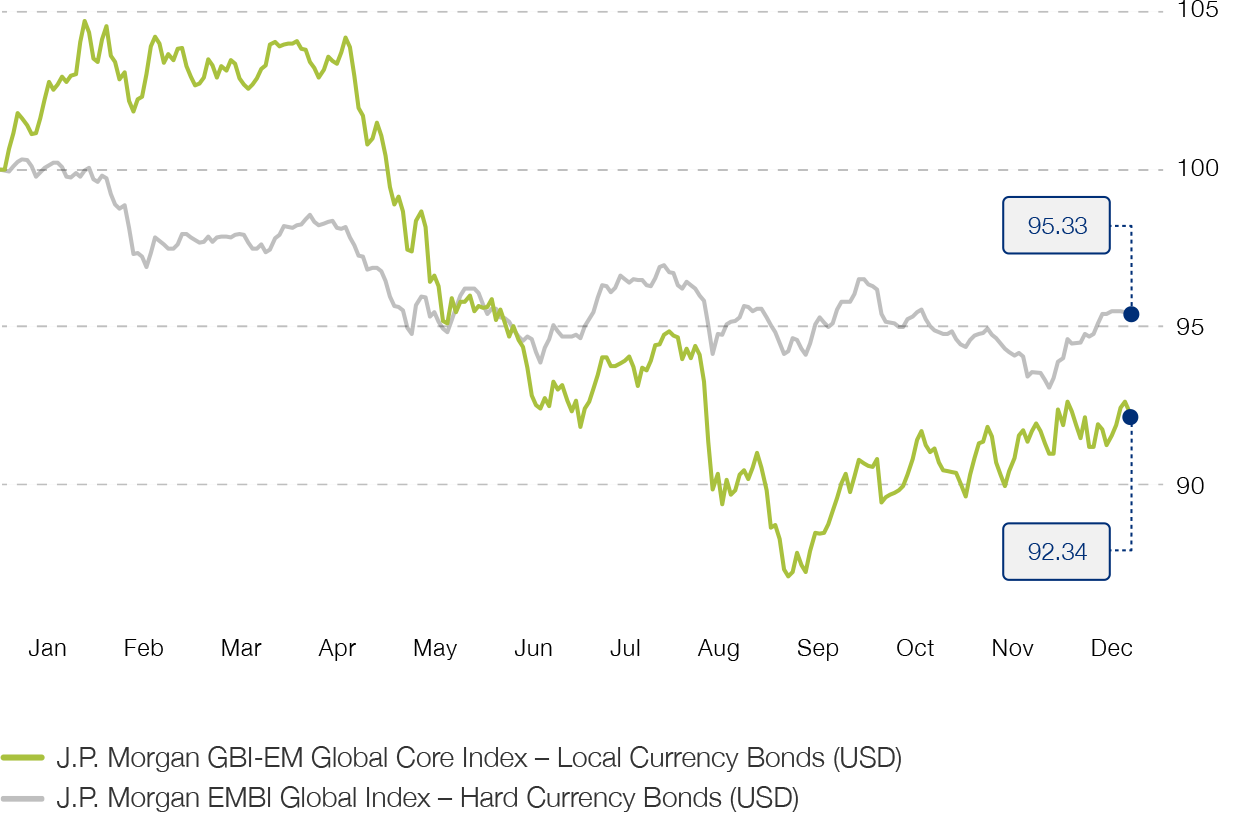

In view of declining economic expectations for the global economy, there are signs of a top in long-term interest rates. The first choice remains floating rate investments in US dollars. But the long end of the curve has also become more attractive.

In the euro zone, Italy remains at the forefront. Opportunities lie in inflation-protected bonds and emerging market bonds. The credit markets continue to cause instability.

Opportunities for emerging market bonds

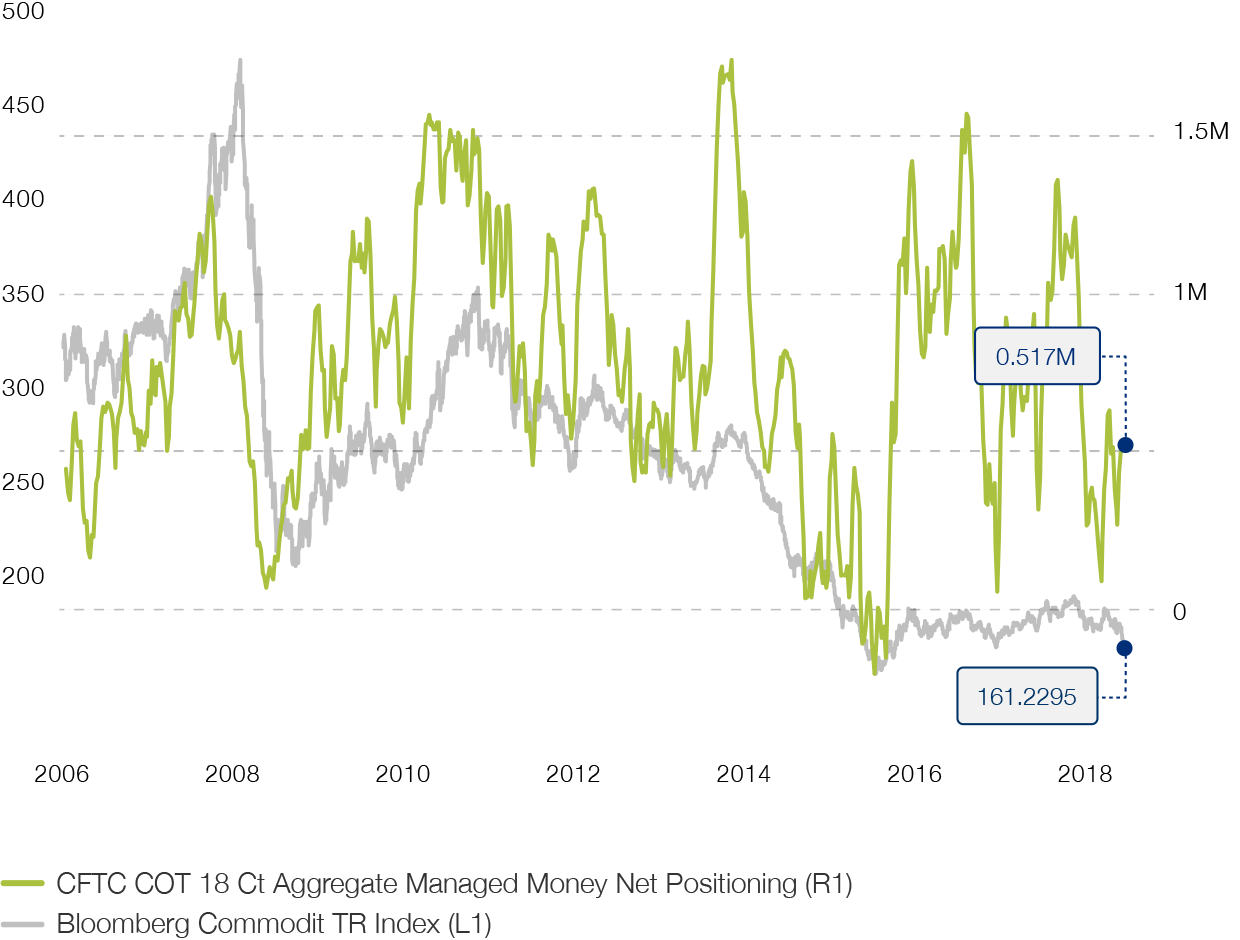

Commodities

Geopolitical and macroeconomic factors led to a disappointing development of commodity markets in 2018. However, the continued robust late cyclical expansion of the global economy underpins expectations of a rebound in commodity markets over the coming year.

Investor engagement at the lower end